Bookkeeping is often overlooked by real estate agents, yet it plays a crucial role in maintaining a healthy business. As a real estate agent, you’re juggling multiple clients, transactions, and income streams to make it easy for finances to become disorganized.

Without a solid bookkeeping system in place, you may struggle with staying on top of tax obligations, managing cash flow, and ensuring that you’re maximizing your earnings. This is particularly concerning because real estate agents face unique financial challenges—primarily irregular income, frequent commission-based payments, and numerous expenses that can easily spiral out of control.

The truth is, without proper bookkeeping, you risk losing track of valuable deductions, mismanaging funds, and, worst of all, finding yourself in trouble with tax authorities. From keeping receipts for office supplies and travel expenses to calculating commissions or tax deductions, effective bookkeeping allows real estate agents to focus on what they do best—closing deals—while ensuring that their financial records are in order.

In this blog, we’ll walk you through the essential practices every real estate agent needs to follow to keep their finances on track.

Why is Bookkeeping Essential for Real Estate Agents?

Real estate agents often operate in a dynamic environment where every deal can lead to a significant financial impact. Unlike salaried employees, agents typically work on commission, meaning their income can fluctuate drastically depending on the number of transactions they close in a given month. This makes accurate bookkeeping not just important but essential for real estate professionals to maintain financial stability and ensure that all earnings are properly tracked.

One of the biggest challenges faced by real estate agents is the irregularity of their income. Commissions may come in bursts, often following long periods without a sale. Without proper bookkeeping practices, it’s easy to lose track of how much you’ve earned or how much you owe in taxes. Therefore, this can lead you to potential cash flow problems. That is why, you need to regularly update your financial records to ensure that you are managing your income and expenses effectively.

Moreover, real estate agents often incur a wide range of business expenses that must be carefully tracked to optimize tax deductions. These expenses can include things like:

- Marketing costs

- Office supplies

- Transportation to showings

- Meals or entertainment when meeting clients.

Without keeping detailed records, agents may miss out on valuable deductions, potentially resulting in paying more in taxes than necessary. Bookkeeping helps you identify these expenses, categorize them correctly, and ensure that you’re only paying what you owe.

Lastly, keeping your financials organized throughout the year is essential for tax purposes. Real estate agents, like any self-employed individuals, must file taxes quarterly and annually. Having clean, well-maintained books ensures that when it comes time to file, there are no surprises. Accurate records also make it easier to work with accountants, ensuring they can help you maximize your returns or minimize your liabilities based on up-to-date and accurate financial data.

Common Financial Challenges Real Estate Agents Face

Real estate agents encounter a variety of financial challenges, many of which are unique to the profession. The unpredictable nature of commission-based income, coupled with a high volume of transactions, can quickly overwhelm even the most diligent agent without the right financial management practices in place. Understanding these challenges is the first step toward addressing them effectively.

These challenges include:

Managing Inconsistent Income

- Real estate agents rely on commission-based income, which fluctuates based on the deals they close.

- This can result in months of high earnings followed by periods of little or no income, creating cash flow problems if not properly managed.

- Regularly tracking earnings and budgeting for lean months is crucial to maintaining financial stability.

Tracking Commission-Based Income

- Commissions are often split with brokers and other agents, which can lead to confusion over how much is earned and owed.

- Multiple deals with varying commission rates and adjustments make it difficult to track payments accurately.

- A well-organized bookkeeping system helps agents track each transaction and ensure they are paid correctly for every deal.

Managing Business Expenses

- Real estate agents incur a variety of business expenses such as marketing costs, travel, client dinners, and office supplies.

- Without proper bookkeeping, it’s easy to overlook expenses or fail to categorize them correctly.

- Effective bookkeeping helps agents track expenses, ensuring they understand their profitability and are ready for tax season.

Navigating Complex Taxes

- As self-employed individuals, agents must handle both income tax and self-employment taxes (Social Security and Medicare contributions).

- Keeping track of quarterly estimated tax payments, deductions, and credits can be overwhelming.

- A reliable bookkeeping system helps agents stay on top of their tax obligations and avoid penalties or surprises at year-end.

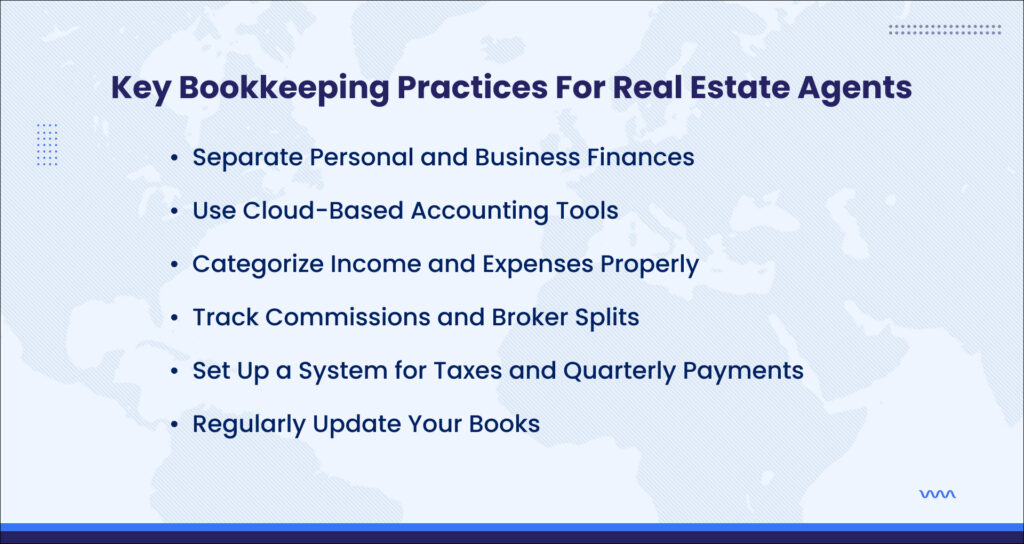

Key Bookkeeping Practices for Real Estate Agents

To stay on top of their finances, real estate agents must adopt effective bookkeeping practices. These practices not only help ensure accurate record-keeping but also make tax season smoother and more predictable. Here are some key bookkeeping practices every real estate agent should follow:

Separate Personal and Business Finances

- Mixing personal and business finances is a common mistake, but it makes bookkeeping much more complicated.

- Opening a separate business account ensures that business expenses, income, and tax obligations are distinct from personal finances.

- This separation also provides a clear picture of your business’s profitability and makes tax filings easier.

Use Cloud-Based Accounting Tools

- Cloud-based accounting software such as QuickBooks, Xero, or FreshBooks allows agents to manage finances from anywhere.

- These tools can automate many bookkeeping tasks, such as categorizing transactions, sending invoices, and tracking payments.

- With cloud-based systems, agents can stay organized and ensure their financial data is always up to date and accessible.

Categorize Income and Expenses Properly

- Proper categorization of income and expenses is vital for accurate reporting and tax preparation.

- For example, income should be categorized based on the type of transaction—whether it’s commission from a sale, referral fees, or other sources.

- Expenses should be categorized as either business-related (marketing, office supplies, etc.) or personal (if any personal expenses are mixed).

- Clear categories help agents track their financial performance and identify potential deductions during tax season.

Track Commissions and Broker Splits

- Real estate agents often split commissions with brokers or other agents.

- It’s crucial to track these splits accurately to ensure agents know exactly how much they’re earning from each deal.

- Having a detailed breakdown of commissions can prevent errors when calculating earnings and help manage the financial impact of broker fees.

Set Up a System for Taxes and Quarterly Payments

- As self-employed individuals, real estate agents are responsible for paying quarterly estimated taxes.

- Setting aside a percentage of income for taxes, such as 25-30%, helps prevent financial strain when tax payments are due.

- A good bookkeeping system should track tax payments, making it easier to calculate how much is owed each quarter.

Regularly Update Your Books

- Keeping your books up to date is essential for making informed business decisions.

- Setting aside time each week or month to update your records ensures that you are always on top of your finances and helps prevent backlog.

- Regular updates also make it easier to identify discrepancies, allowing for faster correction before they become major issues.

Leveraging Technology for Better Bookkeeping

Gone are the days of manually tracking every transaction in spreadsheets or physical ledgers. With the advent of cloud-based accounting software and other digital tools, agents now have access to powerful resources that can save time.

Cloud-based accounting platforms like QuickBooks, Xero, and FreshBooks are particularly beneficial for real estate agents because they provide a centralized, real-time overview of their financials. These platforms automatically sync with your bank accounts and credit cards, categorizing transactions as they occur.

Moreover, many of these tools come with specialized features designed for the real estate industry. For example, QuickBooks offers a feature that can track commission-based income and automatically calculate how much is owed from each sale. Xero also integrates with property management systems. By using these platforms, agents no longer have to manually calculate commissions.

Another advantage of using technology for bookkeeping is the ability to easily generate reports. With just a few clicks, agents can access detailed financial reports that provide insights into their business performance. These reports can include:

- Profit and loss statements

- Balance sheets

- Cash flow statements

- Tax report

Real estate agents can use these reports to identify trends, make informed decisions about their business operations, and prepare for tax season without scrambling to gather data at the last minute.

Lastly, technology allows for collaboration with other professionals, such as accountants or financial advisors. Cloud-based systems enable agents to share their financial data securely with their accounting team, allowing for real-time updates and eliminating the need for back-and-forth emails or physical document exchanges. This collaborative approach can lead to more accurate financial reporting and better planning, as accountants can offer advice based on up-to-date financial data rather than outdated records.

The Importance of Working with a Professional Accountant

While real estate agents can handle much of their bookkeeping themselves, working with a professional accountant brings significant advantages, especially when it comes to managing complex financial situations.

Accountants offer expertise and knowledge that can save agents time, reduce tax liabilities, and prevent costly errors. They are also invaluable when it comes to planning for long-term financial goals and ensuring that an agent’s business remains financially healthy and compliant with tax regulations.

One of the main benefits of working with an accountant is their ability to ensure compliance with tax laws. The tax laws that apply to real estate agents can be complex and are subject to frequent changes. A professional accountant is well-versed in these laws and can ensure that agents are complying with all relevant regulations. They will help identify any potential tax issues before they become problems, preventing fines or audits.

Accountants also provide valuable insights into financial planning. By reviewing an agent’s books and financial situation, they can offer advice on ways to save money, reduce expenses, and maximize income. For instance, an accountant may suggest strategies for tax savings, such as setting up a retirement account or taking advantage of other tax-efficient investment options. They can also assist with creating long-term financial plans that align with an agent’s business goals, whether it’s saving for retirement, expanding the business, or preparing for large expenditures.

Another key advantage of working with an accountant is their ability to optimize deductions. Real estate agents are eligible for numerous tax deductions, but many agents overlook potential deductions or fail to categorize expenses correctly. A professional accountant is experienced at identifying eligible deductions and ensuring that they are properly documented and claimed. This can result in significant tax savings over time. Furthermore, an accountant can advise agents on the most tax-efficient way to structure their business, helping them reduce their overall tax liability.

Accountants can also be a crucial resource for financial forecasting and budgeting. Many real estate agents struggle with cash flow management due to the irregular nature of commission-based income. An accountant can help agents forecast their income and expenses, allowing them to plan for lean months and avoid financial instability. They can also assist in creating a realistic budget that accounts for both personal and business expenses, helping agents stay financially on track.

Finally, working with an accountant allows real estate agents to focus on growing their business. By delegating the financial and tax-related tasks to a professional, agents can spend more time on activities that directly contribute to their success, such as building relationships with clients, marketing properties, and closing deals. This not only increases productivity but also provides peace of mind, knowing that their financial affairs are in capable hands.

In conclusion, while bookkeeping is a critical part of a real estate agent’s business, working with a professional accountant offers numerous benefits. From ensuring tax compliance and optimizing deductions to providing financial planning advice and forecasting, an accountant plays a vital role in keeping an agent’s finances on track. By outsourcing accounting and tax duties to an expert, real estate agents can focus on what they do best—serving their clients and growing their business.

How to Handle Real Estate Commissions in Your Bookkeeping?

Real estate commissions are a key source of income for agents, but managing them in bookkeeping requires careful attention to detail. Because commissions can vary significantly from deal to deal, it’s essential to track them accurately to avoid financial confusion.

The first step in handling commissions is to document each transaction immediately. As soon as a deal closes and a commission is earned, make sure to record the amount, client information, and the date it was received. This allows you to keep track of your income as it flows in and ensures that nothing is missed.

Since commissions are typically paid after a deal is completed, it’s also important to plan for delays in payment. While you may have earned a commission, it may take weeks or even months for the payment to arrive. This delay can create cash flow challenges, especially if you’re relying on that income to cover other business expenses. By maintaining a separate savings account for commissions, you can keep your operating funds and commission payments separate and avoid cash flow issues.

In addition to tracking commissions, you should also account for commission splits if you work with a brokerage or partner. These splits can impact your bottom line, so it’s important to track your gross commission income as well as the net amount you receive after any splits. Keeping a detailed record of all splits will help ensure that your bookkeeping is accurate and reflect the true income you earn.

Finally, when it comes to taxes, commissions should be treated as self-employment income and reported as such on your tax returns. Since you are likely working as an independent contractor, it’s essential to set aside a portion of your commission income for taxes. Many agents make quarterly estimated tax payments to avoid a large tax bill at the end of the year.

By staying organized and diligent in tracking commissions, you ensure that your income is accurately represented, your cash flow is managed, and your tax obligations are met without surprises.

Keep Your Real Estate Finances on Track with Professional Help

If you have come across this far, you must understand now the importance of accurate bookkeeping, tax planning, and the right tools to maintain financial stability. Whether it’s handling commissions, tracking expenses, or planning for taxes, every aspect of your financial management should be approached with care and precision.

By working with experts like The Pro Accountants, you can ensure that your finances are well-managed, compliant, and optimized for growth. Our team specializes in providing personalized bookkeeping services tailored to the needs of real estate agents, so you can focus on what you do best—closing deals and growing your business.

Don’t let your finances hold you back from reaching your full potential. Schedule a meeting with The Pro Accountants today, and let us help you streamline your bookkeeping and take your real estate business to the next level.

Frequently Asked Questions

Why is bookkeeping important for real estate agents?

Bookkeeping helps real estate agents track income and expenses, manage cash flow, stay compliant with tax laws, and make informed business decisions. Accurate financial records are essential for avoiding tax issues, maintaining profitability, and ensuring long-term business success.

What expenses can real estate agents deduct from their taxes?

Real estate agents can deduct a variety of business-related expenses, including vehicle costs (mileage or actual expenses), home office expenses, marketing and advertising costs, professional fees (e.g., licensing, continuing education), and client-related expenses like meals and entertainment, subject to IRS rules.

How do I track my real estate commissions in bookkeeping?

You should record your commission income as soon as the deal closes, ensuring to separate gross commissions from your net income after any splits. Maintaining detailed records of each transaction will ensure that all commissions are accounted for, whether or not they’ve been received.

What tools can I use to simplify my real estate bookkeeping?

Tools like QuickBooks, Xero, FreshBooks, and Wave are popular among real estate agents. These platforms help you track income and expenses, generate reports, and stay organized. Many offer integrations with other tools like CRM systems, making it easier to manage your entire business workflow.

How can I manage irregular income as a real estate agent?

Since commissions vary, it’s important to create a budget that accounts for fluctuating income. Consider saving a percentage of your income each month to cover slow periods. A dedicated savings account for commissions can help smooth out cash flow issues and ensure you’re prepared for expenses.

Do I need a separate business bank account for my real estate business?

Yes, it’s highly recommended to have a separate business bank account to keep personal and business finances distinct. This makes it easier to track income and expenses, reduces the risk of mixing personal and business funds, and simplifies tax reporting.

What is the best way to handle taxes as a real estate agent?

As a self-employed individual, real estate agents are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. It’s advisable to set aside a portion of each commission for taxes and to make quarterly estimated tax payments to avoid a large tax bill at year-end.

Can I claim deductions for marketing and advertising expenses?

Yes, expenses related to marketing your real estate business are deductible. This includes costs for digital ads, website maintenance, business cards, promotional materials, and other marketing strategies aimed at generating new clients and deals.

How often should I review my finances as a real estate agent?

Regular financial reviews are crucial for staying on top of your business’s health. Aim to conduct a financial review at least quarterly, though monthly reviews can provide more insight into cash flow and expenses. This allows you to catch potential issues early and make adjustments as needed.

Can I outsource my bookkeeping as a real estate agent?

Yes, many real estate agents choose to outsource their bookkeeping to professional accountants or bookkeeping services. Outsourcing can save time and reduce stress, allowing you to focus on clients and sales while ensuring your financial records are accurate and up to date.