Managing the finances of a small homeowners association (HOA) can often feel like navigating a maze. With limited resources, tight budgets, and a diverse group of stakeholders, you face unique challenges when it comes to keeping your financials in order. Whether it’s tracking monthly dues, managing reserve funds, or ensuring transparency to avoid disputes, the need for meticulous bookkeeping is paramount.

Bookkeeping for small HOAs isn’t just about keeping the lights on; it’s about building trust within the community, making informed financial decisions, and preparing for the future. It can be the difference between smooth operations and costly mistakes.

In this blog, we’ll explore essential bookkeeping tips tailored to the needs of small HOAs, with practical advice to help simplify financial management. From selecting the right software to preparing for audits, we’ll break down the steps and ensure that its financials are always in top shape.

Common Bookkeeping Challenges for Small HOAs

Small homeowners associations often face a unique set of challenges when it comes to managing their finances. Due to their limited size and resources, their bookkeeping is typically handled by a small group of volunteers, or even just a few board members. This can result in common financial management issues, such as:

- Limited Resources and Manpower

Small HOAs often operate on tight budgets with minimal staff. As a result, board members or volunteers are tasked with managing finances in addition to their other duties. This lack of dedicated resources can lead to financial oversight being pushed to the back burner, especially in busy periods. - Complexity of Managing Dues and Fees

Small HOAs usually depend on regular member dues and assessments to maintain operations. However, tracking these payments can become cumbersome. Members may have varying payment schedules, late payments are common, and some may struggle to meet payment deadlines. - Lack of Financial Transparency

Without a clear and transparent financial system, residents can become frustrated or suspicious of how their dues are being allocated. This often leads to disputes within the community, which can be time-consuming and harmful to the HOA’s reputation. Transparent financial reporting and regular updates are essential to building trust among homeowners.

- Difficulty in Staying Compliant with Regulations You must follow strict state and federal regulations, which can be complex and difficult to navigate. Missing out on regulatory requirements, such as tax filings, can result in fines or legal consequences. Being a HOA, you may not have the expertise to keep up with changing tax codes and other compliance regulations, putting them at risk.

These challenges can create a heavy burden, but they are not insurmountable. By implementing effective strategies and tools, HOA bookkeeping can become a smoother, more manageable process.

Why Bookkeeping for Small HOAs is Different?

Bookkeeping for small homeowners associations is not the same as handling finances for a typical business or personal accounts. Small HOAs operate within a unique financial framework that requires special attention to detail. Unlike businesses that focus on profits and losses, small HOAs manage funds primarily for the maintenance and improvement of shared property, facilities, and services that directly affect the community’s quality of life.

One key difference is the financial structure of HOAs. In most cases, they must keep their operating fund separate from the reserve fund. The operating fund covers the day-to-day expenses, such as maintenance of common areas, while the reserve fund is intended for long-term expenses, like future repairs or large capital projects.

It’s crucial to have clear and accurate bookkeeping practices that ensure both funds are well-maintained and tracked. Without proper categorization, it can be easy to mismanage or even misuse funds, leading to confusion and potential legal issues.

Transparency is also a significant concern for you. Homeowners expect to see how their dues are being spent, and they want reassurance that funds are being used responsibly. Bookkeepers need to provide clear financial statements and reports that are easily understandable, both for the HOA board and the community members.

These reports should show where money is going, why certain expenses are necessary, and how the association is planning for future financial obligations. This transparency builds trust and ensures that the community feels confident in how their funds are being managed.

Moreover, you often run by volunteer board members who may not have extensive financial backgrounds. This can make bookkeeping more difficult, as these individuals may not be familiar with the complexities of managing:

- Financial records

- Tax obligations

- Compliance with regulations.

For this reason, it’s essential to implement straightforward systems and perhaps seek professional guidance to ensure everything is handled correctly.

Overall, bookkeeping for small HOAs requires a different approach compared to traditional business bookkeeping. It’s not just about balancing the books—it’s about building a financial system that fosters trust, meets legal obligations, and supports the long-term sustainability of the community.

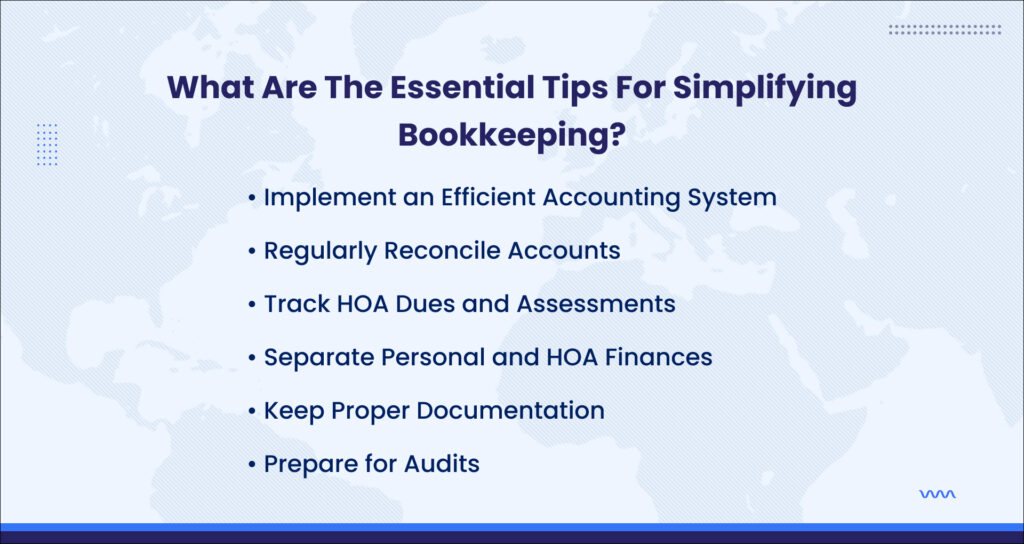

Essential Tips for Simplifying Bookkeeping

Managing the finances of a small HOA may seem daunting, but with the right systems and processes in place, it becomes a much more manageable task. Here are some essential tips for simplifying bookkeeping and ensuring your HOA stays financially organized:

Implement an Efficient Accounting System

Choosing the right accounting software is one of the first steps to streamlining bookkeeping. Many HOA-specific software solutions are available that allow you to track dues, manage payments, generate financial reports, and even automate reminders. Cloud-based systems are especially useful because they provide accessibility from anywhere, ensuring that board members and accountants can work collaboratively from different locations. A good system also ensures data security and makes it easier to retrieve historical records when necessary.

Regularly Reconcile Accounts

One of the most crucial tasks in bookkeeping is reconciling accounts to ensure accuracy. By reconciling the bank accounts, credit cards, and other financial records on a monthly basis, you can catch discrepancies early, prevent errors from piling up, and ensure that everything is in order. Automation tools can help streamline the reconciliation process, saving time and reducing the chances of human error.

Track HOA Dues and Assessments

It’s essential to set up a clear, consistent payment schedule for residents and track payments meticulously. Set up automated invoicing systems and send reminders to homeowners before payment due dates. Tracking late payments promptly and addressing overdue dues can help maintain healthy cash flow for the HOA. Regularly follow up on missed payments to prevent any financial gaps from affecting the HOA’s ability to cover operational costs.

Separate Personal and HOA Finances

To avoid confusion and prevent potential misuse of funds, it’s critical to set up a dedicated HOA bank account. By keeping personal and HOA finances separate, you ensure that the HOA’s funds are used exclusively for their intended purposes. This also simplifies financial reporting and makes it easier to track the association’s income and expenses.

Keep Proper Documentation

Good documentation is key to transparent bookkeeping. Every payment, receipt, contract, and invoice should be well-documented and organized. Keep physical copies where necessary and utilize digital storage for easy access. Creating an organized system—whether it’s based on categories, dates, or vendors—will help ensure that all financial documents are easy to retrieve during audits or board meetings.

Prepare for Audits

Regular audits are crucial for maintaining the integrity of your HOA’s finances. Audits help catch errors, prevent fraud, and ensure that the association is complying with applicable laws. Even if your HOA doesn’t have mandatory audits, conducting periodic self-audits will help ensure that financial records are in order and can provide peace of mind to board members and residents alike.

By following these tips, you can set up systems that simplify financial management, ensure transparency, and reduce the risk of errors or mismanagement.

How Professional Bookkeeping Services Can Help?

While you might see outsourcing as an additional expense, however, the benefits of professional bookkeeping services far outweigh the cost. Professional services provide expertise, efficiency, and peace of mind, allowing your board members to focus on more important tasks, such as managing community relations and overseeing projects.

By hiring a professional bookkeeping service, you can avoid common pitfalls like inaccurate financial reporting, missed payments, and compliance issues. Here are some key ways professional services can make a difference:

Expertise and Experience

Professional bookkeepers are trained to handle the unique financial needs of your business. They understand the nuances of managing reserve funds, tracking assessments, and preparing financial statements that meet regulatory requirements.

Time-Saving Automation

They often employ advanced software that automates key tasks, such as invoicing, payment tracking, and financial reporting. This automation not only reduces the risk of errors but also frees up board members’ time to focus on other aspects of HOA management

Improved Financial Transparency

One of the most important aspects of HOA bookkeeping is maintaining transparency with residents. Professional bookkeepers can provide clear, detailed financial statements that are easy to understand to ensure that homeowners are informed about how their dues are being spent.

Risk Mitigation

As you are at risk of non-compliance with state and federal regulations, professional bookkeeping services can help mitigate this risk by ensuring that the HOA adheres to tax laws, reserve fund requirements, and other legal obligations. Moreover, regular audits and financial reviews help identify potential issues before they become serious problems.

Scalability and Flexibility

As your business grow, your financial management needs will likely evolve. They service providers can scale your support to meet these changing needs, providing more advanced services or additional support as necessary. This flexibility ensures that your financial management remains efficient as the association expands.

So, by outsourcing bookkeeping, you gain access to the expertise and tools necessary to maintain smooth, accurate financial management.

Choosing the Right Bookkeeping Service for Your HOA

With so many service providers available, it can be difficult to determine which one is the best fit for your association’s specific needs. Choosing a service that aligns with the goals and requirements of your small HOA can streamline operations, improve financial reporting, and ensure that your association stays on track with its obligations.

When evaluating bookkeeping services, there are several factors that small HOAs should consider:

Industry Experience

The first and most important factor is whether the bookkeeping service has experience working with homeowners associations. HOA bookkeeping comes with its own set of challenges, such as managing dues, handling reserve funds, and ensuring compliance with specific regulations. Working with a provider that understands the intricacies of HOA financial management can save time and prevent costly mistakes.

Reputation and Reviews

Before committing to any service, it’s essential to check the reputation of the bookkeeping provider. Look for reviews and testimonials from other HOAs or similar organizations to get a sense of their reliability, customer service, and quality of work. A good reputation is a strong indicator that the service will meet your expectations and provide the level of care your HOA deserves.

Range of Services

Different bookkeeping services offer different levels of support. Some may only provide basic accounting services, while others may offer comprehensive solutions, including tax preparation, auditing, financial reporting, and software integration. Assess your HOA’s needs and choose a service that offers the full range of support required to manage your finances effectively. Ensure that the provider can handle specific needs such as managing reserve funds or preparing for audits.

Technology and Tools

The right bookkeeping service should be equipped with the latest tools and technology to manage finances efficiently. Cloud-based software can allow for easy access and collaboration, which is essential for small HOAs that may have board members working remotely or on different schedules. Additionally, automation tools can streamline processes like invoicing, reminders for late payments, and report generation, saving time and reducing errors.

Transparency and Communication

Communication is key when choosing a bookkeeping service. You need to feel comfortable asking questions and requesting updates about your HOA’s financial status. A good bookkeeping service should offer transparent reporting, clear explanations, and open communication channels. They should be willing to provide financial statements in formats that are easily understood and be available for regular updates and consultations as needed.

Cost and Value

Cost is always a factor, but it’s important to look at the value the service provides for the price. Some bookkeeping services may offer lower fees but lack the comprehensive support you need. Others might charge higher rates but offer more advanced tools, expertise, and a higher level of service. Be sure to weigh the cost against the benefits and ensure that the service you choose offers the best value for your HOA.

Taking the time to carefully evaluate potential bookkeeping services will ensure that your HOA’s financial management is in capable hands.

Best Practices for Long-Term Financial Health Image content:

Create and Stick to a Detailed Budget

Maintain Strong Cash Flow Management

Ensure Financial Transparency

Long-Term Planning and Forecasting

Conduct Regular Financial Reviews and Audits

Take Control of Your HOA’s Financial Future

FAQs

1. What is HOA bookkeeping, and why is it important?

HOA bookkeeping involves the management of all financial records, transactions, and reports for a homeowners association. It is important because it ensures accurate tracking of income and expenses, proper budget management, and financial transparency for both the board and homeowners. Proper bookkeeping also helps in making informed financial decisions, preparing for audits, and maintaining financial stability for the HOA.

2. How often should an HOA review its financial reports?

An HOA should review its financial reports at least quarterly. Regular reviews help identify discrepancies, track budget adherence, and ensure that funds are being spent appropriately. More frequent monthly checks are ideal for smaller associations with tighter budgets, allowing the board to catch potential issues early and make necessary adjustments.

3. What documents should be kept for HOA bookkeeping?

Essential documents for HOA bookkeeping include:

- Bank statements

- Invoices and receipts for expenses

- Contracts with vendors

- Financial statements (profit and loss, balance sheet)

- Budgets and reserve fund information

- Tax documents and filings

Maintaining these records ensures compliance, transparency, and readiness for audits.

4. Can I handle HOA bookkeeping on my own, or should I hire a professional?

While small HOAs may handle basic bookkeeping internally, hiring a professional is recommended to ensure accuracy, compliance, and efficiency. Professionals have the expertise to manage complex tasks, such as reserve fund management, tax filings, and audits. Outsourcing bookkeeping also saves time and ensures that the HOA is following best practices for financial management.

5. What is the role of reserve funds in HOA bookkeeping?

Reserve funds are savings set aside for major repairs, replacements, and capital improvements within the community. In HOA bookkeeping, properly managing reserve funds is crucial for avoiding special assessments and ensuring that the HOA can cover large expenses without straining operating budgets. Reserve fund planning is typically included in the annual budget and should be regularly reviewed to meet future needs.

6. How can an HOA ensure its bookkeeping is transparent?

To ensure transparency, an HOA should provide clear and easily understandable financial reports to all homeowners regularly. Reports should include details of income, expenses, and the status of reserve funds. Offering quarterly or annual financial statements and holding open meetings where financial matters are discussed will help foster trust and accountability within the community.

7. How does an HOA prepare for an audit?

Preparation for an HOA audit involves organizing and reviewing all financial records. This includes ensuring that bank statements, invoices, contracts, and financial reports are accurate and up-to-date. The HOA should also ensure that all transactions are properly documented and categorized. Hiring a professional bookkeeper can make the audit preparation process easier and more efficient.

8. Should we hire a professional bookkeeper or do it ourselves?

Hiring a professional bookkeeper can provide expertise, ensure compliance with regulations, and save time for the board members. For smaller HOAs with limited budgets, outsourcing bookkeeping can reduce the risk of errors and ensure that financial records are handled properly. However, if the HOA has the capacity and skillset, managing finances internally with appropriate training may work as well.

9. What should be included in an HOA’s annual budget?

An HOA’s annual budget should include all operational expenses (e.g., maintenance, utilities, insurance), reserve fund contributions, special assessments (if any), and anticipated repairs or upgrades. It should also account for recurring costs such as payroll for staff or contractors. Ensuring the budget is comprehensive and realistic helps prevent overspending and ensures funds are available for unexpected expenses

10. How do we communicate our financials to homeowners effectively?

Clear, concise financial reports should be provided to homeowners on a regular basis, typically quarterly or annually. These reports should include income and expense summaries, reserve fund updates, and any significant budgetary changes. Utilize easy-to-understand formats like charts or graphs to make the information more digestible. Consider hosting regular meetings or online sessions to answer questions and explain the financial status in detail.