Have you ever analyzed the financial insights of your business before the accounting period ends? You must speak to professionals to complete this job, as a team of qualified and certified financial advisors can help you analyze the financial performance of your business in no time. The growth of the business is every owner’s dream today, so evaluation of finance is a must to seek positive outcomes. This is why, the current analysis of finance leads to the path of success and glory.

What Is a Cash Flow Statement?

A cash flow statement (CFS) is the process of measuring and managing the cash position of a business. In this statement, professionals provide financial health of business insights associated with the inflow and outflow of cash. Without any doubt, it is the financial statement that presents how much cash has been entered and exited in the company during the fiscal year.

In simple words, cash that comes in and goes out is known as the cash flow that accountants analyze for recording transactions and making financial reports. Additionally, a chief financial officer always focuses on driving the best results by running a professional team of certified accountants and the top goal of every CFO is to generate cash for the company and minimize liabilities.

Another top concern of an accounting executive is to take care of operating activities, investing activities, and most importantly financing activities before the accounting year ends. For this purpose, the experts pay debts and reduce expenses to utilize company funds for efficiently running operations.

Without seeing financial statements such as a balance sheet and income statement, it becomes difficult for them to prepare reports and figure out the cash flow. More importantly, it guides owners to spend and utilize their cash for a better purpose.

Key Features

- Summarizes and records the cash details coming in and going out of the business.

- Guides an accountant to figure out how much cash a company generates during the accounting period.

- Allows experts to analyze balance sheets and income statements for preparing a final report.

- Deals in operating, investing, and financing activities during the accounting year.

- Uses two methods for calculating cash flow including direct and indirect method

- The two methods of calculating cash flow are the direct method and the indirect method.

Why Use Cash Flow Statement?

Using cash flow details is necessary for running business affairs. There are so many reasons to do so, as it allows chief financial officers to determine from where the cash comes into business and where it goes out. It means how companies spend their money and how they earn it.

Interestingly, they determine how much cash on hand is available and what are the dues owned by the company at present. The basic purpose is to manage business operations for planning a strategy to pay debts and utilize company funds for reaching better output and improving the decisions of a company.

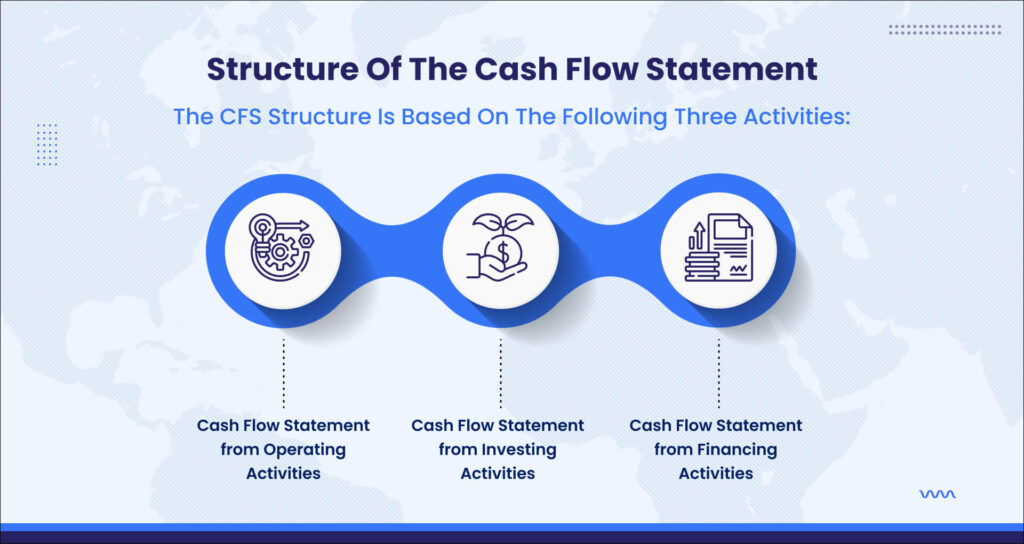

Structure of the Cash Flow Statement

The structure of cash flow relies on the following three activities!

- Cash from Operating Activities

- Cash from Investing Activities

- Cash from Financing Activities

These three activities rely on cash flows that organizations follow under the generally accepted accounting principles (GAAP). Let’s elaborate on these activities!

Cash From Operating Activities

Operating activities determine how much cash a company generates after selling the products and services. Hence, a company utilizes the resources and makes an effective use of cash from operating activities.

Additionally, the operating activities include interest payments, income tax payments, salaries, wages, rent payments, manufacturing payments, sale receipts, and all other expenses that fall into this activity. Despite these payments, the sale of loans, debts, and equity instruments also falls in this category.

Cash From Investing Activities

Investing activities are different from operating activities, as the cash flow involves the investments made by the companies. Additionally, the sale or purchase of assets and loans made to vendors and payments received from customers fall in this category. Businesses invest cash and buy equipment, buildings, and securities.

Cash From Financing Activities

Financing activities include cash sources that come from banks and investors. Companies pay cash to shareholders which includes dividends, repurchasing stock payments, and loans made by the company. Cash financing activities bring the cash in when more capital is raised and leave cash out when a company pays dividends.

Cash Flow Calculation Methods

There are two methods of calculating cash flows, one is direct and the other is indirect method.

Direct Cash Flow Method

The direct cash flow method includes cash receipts and payments. These are the cash payments made to suppliers and cash receipts from customers. This also includes paying salaries in cash and this practice is ideal for small-sized businesses especially when focusing on the cash-basis accounting method.

Interestingly, the accountants also keep a check on increases and decreases of assets and liabilities in the accounts and this direct CFS method works far better than the indirect method.

Indirect Cash Flow Method

The indirect cash flow method is the adjustment of net income that accountants manage by adding and subtracting the differences coming from non-cash activities. Usually, the indirect cash flow is the change that experts observe in the assets and liabilities during the accounting period.

Moreover, accountants make decisions either to add or remove the differences in the assets and liabilities to determine the actual cash inflow and outflow. No doubt, the changes in the accounts have an impact on the new cash flow statement especially when we look at the accounts receivables.

With the decrease in accounts receivable, the company seeks an opportunity to generate more cash from customers. This decrease also reflects the addition of net earnings. On the other hand, an increase in receivables needs to be deducted from the net earnings.

Difference Between Cash Flow Statement, Income Statement, and Balance Sheet

Cash flow measures the performance of the company over the year. However, accountants create these cash flow details after creating the balance sheet and income statement. They drive cash details from the net earnings using the income statement and come across operating activities.

But these activities are different from financial and investing activities. Depreciation expense is also included in this statement and more likely it is the allocation of asset’s cost. In this way, it becomes easier to find inflows and outflows using the income statement.

For the balance sheet, the cash flow report on the CFS must be equal to the net change that appears on the balance sheet. Further, this requires the exclusion of cash equivalents and other non-cash accounts and you need to have a previous year’s balance sheet to calculate CFS for the current year.

Difference Between Direct and Indirect Cash Flow Statements

There is a difference between direct and indirect cash flows that is more likely linked to the differences in the inflows and outflows. Direct cash flow is a straightforward process that figures out the actual cash payments and receipts following a direct method. Also, the cash inflows and outflows are not hidden in the direct method.

The indirect method is different from the direct one, as the inflows and outflows are not known in this method. This method starts with loss and net income appears on the income statement. Importantly, the modification takes place using the balance sheet to find the accurate inflows and outflows.

Did You Know?

“In the language of finance, the Cash Flow Statement speaks volumes, revealing the true story behind a company’s financial health”.

Choose TPA For Getting CFS Done – Your Partner in Accounts

Are you searching for the right organization to get your cash flow statements ready? Choose The Pro Accountants to get this job done. We are a company built with a vision to assist midsize to enterprise businesses globally. Our competent accountants are there to offer you a wide range of accounting and finance services including CFS on your demand. Let’s connect with our accountants today!