Fiscal stability is a key to any business. This stability does not come with bigger revenues only. However, it is also influenced by the extent of adherence to the proper protocols and measures to maintain a precise, accurate, and up-to-date record of all the financial activities and cash flow. However, it is not as easy and simple as it appears.

According to a Gartner Inc. survey, a lot of mistakes are made while keeping this record by accountants. Configuring the scope of errors in numerical form, around 18% of accountants make a financial mistake every day while 59% of accountants make mistakes in financial records owing to capacity constraints or other issues.

Despite all the requirements, sometimes due to the workload and other activities to catch on in a business, bookkeeping is often neglected or set aside. And that is a harsh reality that if you miss a routine practice for once, it seems daunting to continue it or bridge the gap. In the long run, it seems nearly impossible that you will be able to make up for the missing work. However, it is essential to overcome the backlog and catchup bookkeeping as soon as possible to avoid any future constraints, fines, liabilities, or issues with managing cash flow.

This blog will provide you with a comprehensive guide to help you catch up on bookkeeping that is lagging, streamline your financial performance, and available options of professional catch-up bookkeeping services that are always here to help you out of these situations.

Analyzing the Current Situation of Your Bookkeeping

In order to get started to catch up on bookkeeping, you need to know the ground reality. This focuses on how far behind you are, what is the situation of your financial record, if you opt for a bookkeeping service, how stable your cash flow is to pay for that, and other relevant factors.

The question is what is the science behind knowing all these details? Before discussing the details, let us break down the process into simpler steps.

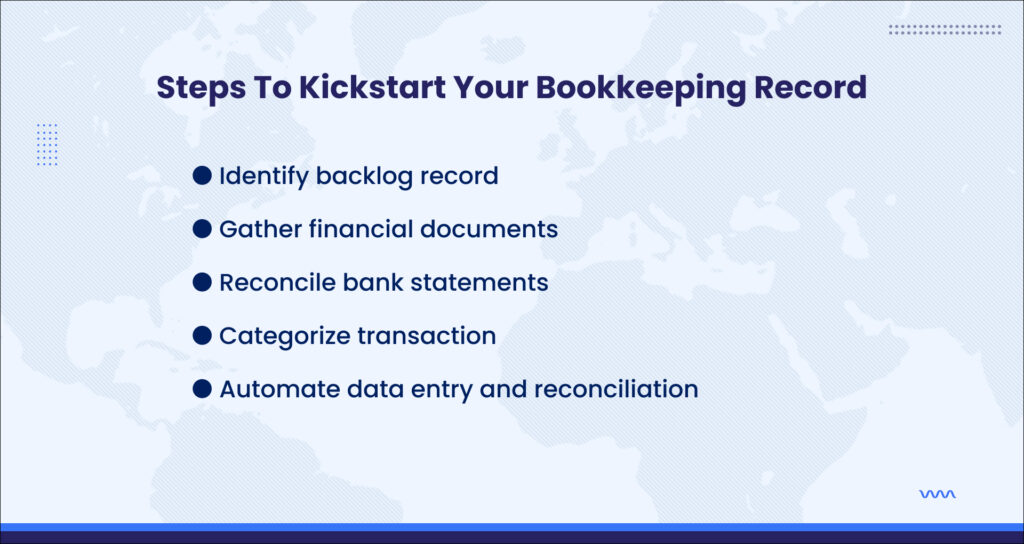

Finding out the duration where your bookkeeping is missing

Starting from the factor of time span, it is essential to know if you are missing a record for a few days, or is it a span of weeks, months, or worst of all which is a nightmare for the fiscal teams, the record is lagging for years.

Once you know this you will be able to break down the duration into segments which can be divided into months and years. This will make the process of catching the missing record easier and more convenient as compared to other practices where you abruptly start doing it, causing more chaos.

Assessing what requires immediate attention

Once your time durations are marked and divided and you know exactly how much you have to make up for, the next step is prioritizing the missing details. You need to understand and identify what requires your immediate attention in this backlog. It can be a record of expenses that are not entered yet, missing invoices, or bank transactions that are not reconciled. When you know what is important, you can create a checklist of that based on the time frame that you set and decided earlier. This will give a direction and kick-start your bookkeeping.

How the backlog is affecting your business

The biggest way to motivate yourself is to look at the adversities and downsides if you do not perform a certain action or task. This applies to bookkeeping too. You need to understand what are the negative impacts on your business because of the backlog. Financial instability is the biggest setback you will face in this cash. Your cash flow will not be consistent and you will be at a risk of legal fines and penalties due to non-compliance with the taxation regulations. Knowing how it can affect you can motivate you to prioritize your bookkeeping.

Gathering Necessary Financial Documents

You have analyzed the state of your bookkeeping in detail, you know what you need, what documents are missing, and what is essentially required without which you can not proceed on this venture. Having organized and complete paperwork and documentation done before you start working on the missing part of bookkeeping will make it more streamlined and smooth ensuring that no detail goes missing.

Enlisting all the required documents is the first thing that you need to do. A comprehensive list of documents and for which timespan you need will work as a win-win situation for getting started as well as entering a record.

These documents may include the bank statements for all the relevant accounts, statements for the credit cards if there are any, the digital and physical receipts of all the expenses, the record of payroll, different invoices, tax filing, and specific anything necessary for your record.

Organizing documents based upon the category is the first thing you need to do after gathering the documents and record. Then sorting it based on year and month will save you a lot of hustle that you may face otherwise. You can even make use of automated document collection through applications that categorize your receipts. It will not only boost your efficiency but will also save time and ensure accuracy.

Reconcile Your Bank and Credit Cards Statement

This is one of the most important steps in the process when you are trying to catch up on bookkeeping. This allows you to take a deeper look into your transaction and cross-check if the transaction in your record is the same as the one on your statement or if there is some loophole. This applies to the statements of your credit card and bank account separately so that accuracy can be ensured.

Understanding the need for reconciliation is the first step as you go on to the backlog of your bank statements. It ensures that there are no missing transactions, discrepancies, double entries, or even unauthorized expenses that are not made on the payroll of the business account. It provides correct information about financial reports leading to better decision making which is in line with compliance and regulations.

Streamlining the reconciliation process systematically, like doing it month by month, can be more effective and easier, you can focus on transactions and records that are manageable now, and you do not need to do an entire year at once. This involves cross-checking your bank and credit statements and transactions and monitoring for outstanding dues or any discrepancies in transaction history which can disrupt the entire fiscal cycle. If you are doing it side by side it would be a lot easier but still, you can use software for automated reconciliation to avoid any error and spending time on tasks that can be automated.

Establishing Defined Categories of Transactions

Considering the fact that you are trying to catch up on bookkeeping after a very long break, things would be very complicated already. You need to keep your record and documentation aligned in a way that they are easy to follow up with. An easy approach to do so is making categories of transactions to ensure compliance, meaningful, and accurate financial reports.

Reviewing account charts for this purpose is useful as it allows you to assess that your charts are set accurately in your relevant software which will lead to a seamless and correct categorization of the transaction. But making categories is not the only task you need to do. You must review and cross-check those categories to ensure that all your categories ranging from income, expenses, liabilities, assets, etc. are non-redundant and there are no similar categories that might confuse you in the future.

Establishing clear categorization guidelines will be very helpful in this context. This standard can help you and your team equally. You can set a specific definition and defined criteria for a specific category by adding its example. This will ensure that everyone has the exact same idea and understanding of a concept which will lead to even more accurate financial reporting. But still, it is important to cross-check the transactions categorized in order to ensure that they are placed correctly and that there is no misclassification of any transaction which may lead to any issue tax or financial reporting related.

Ensuring Efficient Bookkeeping with Software

Automation is key to future innovation and embracing digitalization can help you manage your operations more efficiently and swiftly. This can be applied to your bookkeeping as well as all the sectors including the financial sector are shifting to transformation with innovation, automation, and intelligence.

Software that is capable of streamlining your accounting-related operation is indispensable if you are looking to catch up on bookkeeping that is not been kept or updated for a while now. It can set everything in the right direction with little effort saving you time and cost that you would have to pay otherwise.

Choosing the right software is the first step that you need to take. To get started you must know what are your requirements and what you lack that has to be filled up by that software. Other factors count too, including the size of your business, what industry you are dealing with, and what are the general and specific pain points of your business that you need to bridge up with the software. However, one thing that matters is that the software should be capable of integrating with your existing payroll, CRM, and management tools so that seamless operations can be ensured.

Enhancing efficiency with automation features is possible if utilized properly. For repetitive and data entry kind of tasks, you can redirect them to be done on their own through automation. This can include setting up bank feeds, importing transactions, categorization of transactions, and a lot more. This will save time and keep your records up to date while minimizing the risk of errors and ensuring you work efficiently while catching up on bookkeeping.

Keeping software up to date is as essential as keeping your record. You must look for updates and new features in the system and train your staff accordingly so that you can benefit maximum from that software and enhance the functionality of the software in all possible ways.

Manifesting Consistency Across the Systems

It is really important that your data and systems are consistent and in line with the requirements of your business and are on the same page. When you are dealing with the backlog, inconsistency in the data is a key issue. You must ensure that the data entry is not only accurate but also consistent in the maintenance of your records as it highly influences your financial reporting.

For this purpose, data entry must be scheduled periodically in a way that there are no data silos and your record is updated without putting the burden on your employees. Also, adopt a realistic approach to data entry. You cannot expect to follow up on a monthly record in a day or two, so set a regular schedule for the data entry.

For the backlog, break them into smaller and manageable chunks. It will reduce the overwhelmed situation for your team, ensuring your bookkeeping is more accurate and organized as you progress with it.

Mitigating Errors in Financial Records

A little mistake can cause havoc. Not in monetary terms but also in financial record keeping, taxation, and other legal liabilities. Though these errors are inevitable, identifying and eliminating them timely is necessary to avoid any issues.

Identification of any error or mistake that occurred during data entry is the first step in this process. For this, you must review all the entries and ensure that all entries are made in the correct order, category, and sequence while making sure that no double entry is made or nothing goes missing, especially in terms of transaction and bank statements. Also, note that all the entries are sourced correctly, and there are no such anomalies in the record.

Correcting the errors as you go by is the next step. While you are reviewing the entries, correct any mistake as soon as you come across it. Leaving it for later might end up leaving it unattended. So, the best practice is to correct them as you go. Also, keeping a record of all the corrections helps you avoid them in the future and streamline your audits and reviews.

Training your staff with time is a better approach to polishing their skill and equipping them with the required resources to carry out the process effectively, minimizing the risk of future errors and mistakes.

Opting For a Professional Catch up Bookkeeping Services

According to Deloitte, the spending on outsourcing business grew by 19% from 2022 to 2023. This means businesses are significantly relying on outsourcing their processes and work when they find it difficult to handle or they lack a skilled person for the operation.

If the backlog is overwhelming for you and it is disrupting your current workflow, you might consider getting professional catchup bookkeeping services to bridge the gap. This can help you not only with services but also the much-needed support that will set your book back on track.

How hiring professional services can benefit you is the most frequently asked question. First of all, they are experts in their work. They have a known footprint and established services in accounts, taxes, and compliance.

They can efficiently take over your lagging work. This will help your team to focus on present and future goals while the bookkeeping services catchup on your previous work. It will improve the productivity as well as the profitability of your team.

Choosing the right professional is also a key element that needs to be considered. Start from a checklist that includes service providers in your industry and field and then the ones with a record of testimonials from previous work. Also, consider your requirements. Choose a catchup bookkeeping service that aligns with your needs. But, above all, seamless collaboration and communication can expedite your work process. Entrusting and providing the required documents and information is your responsibility.

Review of Financial Transactions and Statements

It is always an ideal approach to take just another look before you finalize anything as important as account activities. Although the process so far has already identified, examined, and reconciled your transaction-related data, confirmation is pivotal in order to ensure the accuracy of your record. The review can be done in multiple phases while you are working on catchup on bookkeeping by dividing your record as explained below.

Reviewing statements for profit and loss requires the utmost attention in the lifecycle of revenue generation from a business. It helps you to get a deeper insight into the current financial situation of your business by analyzing the trends, expenses, revenue, and profit over the missing time.

Analyzing financial health with balance sheets enables data and analytics-driven decision-making processes. Your record and history direct you to the path of the future. It ensures that your assets and liabilities are updated and none of them goes missing from the record.

Moreover, a cash flow analysis review can provide you with the current state and help you to understand the business’s liquidity. It gives you a bigger picture of the capital that is coming your way, how much is required to sustain your business, keep the operations going, and how it can be utilized for future growth and other courses of action.

Future Proofing Your Accounts with Regular Bookkeeping

It is really hard to catchup with bookkeeping or anything if you once stop it for a while or lag behind. The previous section gave detailed guidance about what to do in case you backlog. But for the future. Do not let it happen again.

There are many reasons you should not let it happen again, and one most important is that you do not want to go through this chaos again. So, setting up a regular bookkeeping routine can help you streamline your financial dealings and keep accounts up to date. Here is what you should do.

- Set a periodic routine for bookkeeping where you get to decide how you want to manage your accounts. Daily data entry is the easiest way to avoid piling up a lot of work. As far as reconciliations and financial reviews are concerned, schedule them weekly and monthly respectively, to ensure a seamless workflow. Assign role-specific responsibilities for this purpose to a team that manages bookkeeping only.

- Automating your routine and repetitive workflow can work as a magic wand. You do not need to perform the tedious and hefty task each day, taking ample time out of your work hours. It will reduce the risk of errors and mistakes and will speed up your entire operations, making sure that your bookkeeping is not left behind.

- When you are leveraging software, automation, and other high-tech roles in your organization and processes, it is very important to keep your staff up to date with regular training and modules. This will make your work accurate and aligned to the compliances.

Transform Your Bookkeeping with The Pro Accountants

The backlog can be a nightmare for any business, and catchup on bookkeeping means you must deploy some of your skilled workforces dedicatedly for this purpose. This will disrupt the operations already in the funnel, and you won’t be sure if catching up on bookkeeping is possible for them.

In this case, you can rely on professional catchup bookkeeping services. While outsourcing this kind of crucial process to a third party, you must consider a few things. Starting from your requirements and available services provided in your industry. Then, filter them on the basis of their past profile, their level of expertise, how equipped and qualified their experts are, and how much it will cost you.

If you are still confused, it is time to leap your faith in The Pro Accountants. Our team has expert accountants who can ensure precise and error-free catchup on bookkeeping, which will give direction and value to your financial growth and performance. Try our services today to enjoy a better tomorrow.