Are you one of those who find themselves rushing to file their taxes at the last minute? Don’t worry; you’re not alone. Many individuals and businesses find themselves in a rush to meet the tax deadline every year.

Nearly two-thirds of filers (67%) have gotten their money back (average refund: $3,213), according to the latest numbers from the Internal Revenue Service.

But fear not, as this comprehensive guide is here to help you navigate the complexities of tax filing with ease. Whether you’re a freelancer, small business owner, or individual taxpayer, understanding the essentials of tax filing can save you time, money, and stress. So, let’s dive in and ensure you’re well-prepared to tackle your taxes, even at the eleventh hour.

Table of Contents

Important Tax Filing Deadlines for Businesses in 2024

As a business owner, it is important for you to know several significant dates to get yourself ready for the upcoming tax year.

- January 15, 2024

It is the due date for the estimated 2023 Q4 tax payment.

- January 31, 2024

It is the W-2 form’s last submission date. You need to submit the forms of your employees to the IRS and deliver copies to employees. Furthermore, it is the deadline for providing a certain 1099 forms to independent contractors.

- March 15, 2024

Partnerships, along with S-corporations, need to file their respective tax returns by this date.

- April 15, 2024

Every corporation and individual must submit their complete tax returns by this date.

- September 16, 2024

This is the last extended date for Partnerships and S-corporations to file their tax returns.

- October 15, 2024

It is the date extended date for any corporation and individual to submit their tax returns.

- January 15, 2025

It is the due date for the estimated 2024 Q4 tax payment.

Is Filing a 1040 Required?

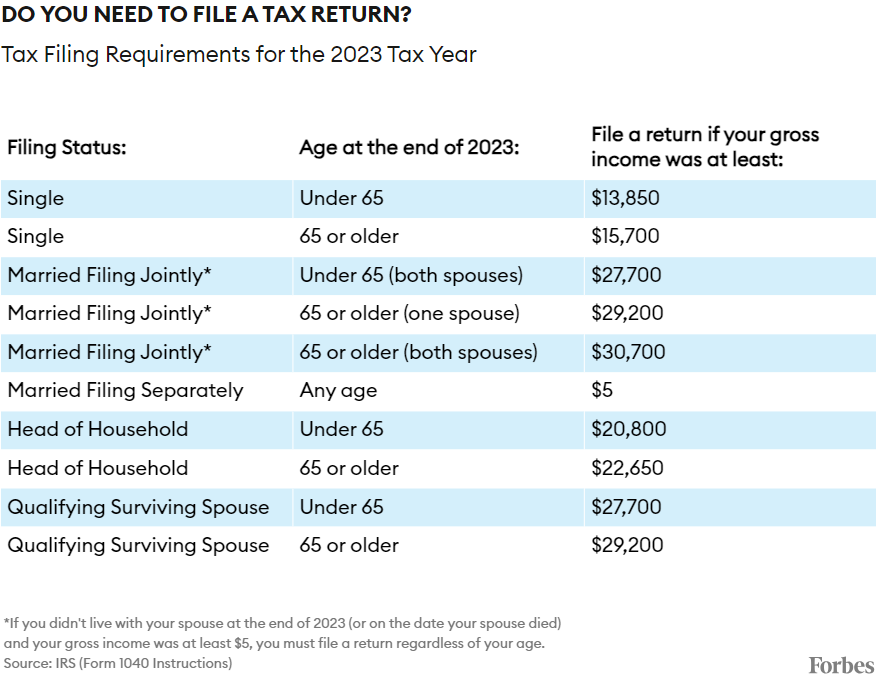

Factors such as age, gross income, and filing status determine whether or not tax returns are required. You are not required to file, but doing so will allow you to claim back any federal income taxes that were withheld.

Along with the EITC, ACTC, American Opportunity Credit, Credit for Federal Tax on Fuels, Premium Tax Credit, and Credits for Sick and Family Leave, you should file if you are qualified for any of these other programs.

Even if none of those things are true, you may still use this table from Forbes to determine if you’re required to file:

If you want to use the chart to your advantage, you need to know that gross income includes all non-exempt forms of income, such as money, commodities, property, and services. Gains from the sale of your primary residence or other assets, as well as profits from your business, as well as income from sources outside the United States are included in this category.

Assets obtained outside of the United States may also need the filing of tax forms and returns in accordance with U.S. filing rules, whether by purchase, inheritance, gift, or any other means. You might not even have to file a return if Social Security is your sole source of income because payments are often not taxed.

Getting Organized to Not Be a Last-Minute Filer

The first step in successfully filing your taxes, especially if you’re doing it at the last minute, is getting organized. Gather all relevant documents such as W-2 forms, 1099s, receipts, and any other income or deduction records. Create a checklist to ensure you have everything you need before you begin the filing process. Organizing your documents will streamline the process and help you avoid overlooking important details that could impact your tax liability.

Understanding Forms Is Crucial

This tax season, the majority of filers will use Form 1040, as Form 1040-EZ, which was widely used, was withdrawn a few years ago. Whether you use software or a tax professional, filing your taxes will be a breeze once you know how Form 1040 works.

Gather all of your important documents and go over them before you begin. This is another wise strategy. Check your Form W-2 for accuracy and to make sure it shows all of your taxable income and any tax benefits, such as 401(k) contributions, even if you have someone else prepare it for you.

Additionally, it is wise to review any announcements made by the Social Security Administration. Form SSA-1099 will provide information about your benefits if you are getting them. The SSA reports your earnings and taxes paid at least once a year, so it’s important to check this report while you’re still working.

Choosing the Right Filing Method

Once you have all your documents in order, it’s time to choose the right filing method. For many taxpayers, electronic filing, or e-filing, is the preferred option due to its speed, accuracy, and convenience. Most tax preparation software programs offer e-filing options and can guide you through the process step by step. If you prefer to file by mail, ensure you use certified mail and send your return well before the deadline to avoid penalties for late filing.

Maximizing Deductions and Credits

One of the most important aspects of tax filing is maximizing deductions and credits to minimize your tax liability. Take the time to review all available deductions and credits that you may be eligible for, such as education expenses, business expenses, and retirement contributions.

Don’t overlook commonly missed deductions, such as charitable donations and medical expenses. Every dollar you save on taxes is money back in your pocket, so be thorough in identifying potential deductions and credits.

Avoiding Common Mistakes

Most of the time, mistakes can be made that delay processing or trigger an audit. Avoid common errors such as mathematical errors, misspelled names, and incorrect social security numbers.

Double-check all entries and review your return carefully before submitting it. If you’re unsure about a particular deduction or credit, seek guidance from a qualified tax professional to ensure accuracy and compliance.

Planning Ahead for Next Year

While filing your taxes at the last minute can be stressful, it’s also an opportunity to start planning ahead for next year. Keep track of changes in tax laws and regulations that may affect your tax situation in the future. Consider consulting with a tax advisor to develop a tax planning strategy that minimizes your tax liability and maximizes your savings. By staying proactive and informed, you can make tax filing a smoother and less stressful process in the years to come.

Wrap Up

Filing your taxes at the last minute doesn’t have to be a daunting task. With the right preparation and knowledge, you can successfully navigate the tax filing process and avoid unnecessary stress. Remember to stay organized, choose the right filing method, maximize deductions and credits, avoid common mistakes, and plan ahead for next year.

And that’s where The Pro Accountants comes in! We not only offer guidance but also set you free from this complex web of taxes by offering you an all-in-one taxation solution. We know ho to control the taxes of businesses like yours to make your business successful in your niche. So that you can achieve peace of mind and financial security for years to come. We are just a link away, so contact us here and step up the ladder of success.