The accounting and finance system is the backbone of every organization. However, with the addition of software technology and artificial intelligence, accountants find it easier to maintain transparent records and organize smooth financial activities.

Additionally, they record accurate transactions and prepare reports that lead to success and strategic decision-making in today’s modern era. For this, companies need to promote finance information systems to drive consistent output.

What is an Accounting Information System (AIS)?

Whenever we talk about information systems linked with financial management, the ultimate purpose of discussing this term is to practice AIS which is the abbreviation of accounting information system. AIS is the process of collecting, storing, retrieving, and reporting accounting-related data for internal use. The reason for using this accounting data is to submit information to tax authorities, investors, and creditors in the form of reports.

Furthermore, the accounting information relies on technology resources and supports computer-based methods for a smooth tracking system. No doubt, AIS is the latest information and technology model that works along with generally accepted accounting principles (GAAP). It’s a mix of technology and traditional accounting rules.

Uses of AIS in Business

AIS is a game-changing factor in the world of accounting and finance. In this system, accountants come across so many crucial things during the accounting cycle. They get a chance to gather data and collect information while keeping in mind the revenue, expenses, and tax details.

The size of the business along with customer details also falls in this information prospect. Using this information system, the experts also analyze and track reports and sales orders along with invoices, inventory, payroll, and financial statements.

The basic target of AIS is to store database information to proceed and manipulate the programming language. However, it comes with several input data fields that also support stored data. AIS is a secured platform that not only stores data, but it takes action against hackers and viruses that may damage the information.

Data manipulation is also required to help accountants simplify the process, as this information system generates reports after examining the details of customers and their assets, liabilities, and financial statements. Additionally, experts don’t include presentations and memos, as they only consider tax calculations and inventories to continue the financial reporting process.

Benefits of Accounting Information Systems (AIS)

If you are aware of the accounting information process that facilitates firms to store and collect data for internal use, the next thing is to find the benefits of AIS. Let’s take a look at the benefits below!

Interdepartmental Interfacing

The top benefit of the accounting information method is the interface that aligns with different departments simultaneously. However, this allows experts to interact with the sales department to identify the sales budget and take deep notice of inventory management. After completing the purchasing process, the inventory team uploads the sales invoice.

Once the job is over, the finance officer gets a chance to determine the accounts payable that further assist in smooth manufacturing, shipping, and customer services.

Improves Control

The internal control remains strong whenever we activate AIS in any firm. It strengthens the internal system and provides complete control to finance officers and accountants who take care of business information, vendors, customers, and the entire system of the organization.

Furthermore, companies perform their routine activities using relevant information that includes login access, authorization, and identifying duties. No doubt, this improves the performance level.

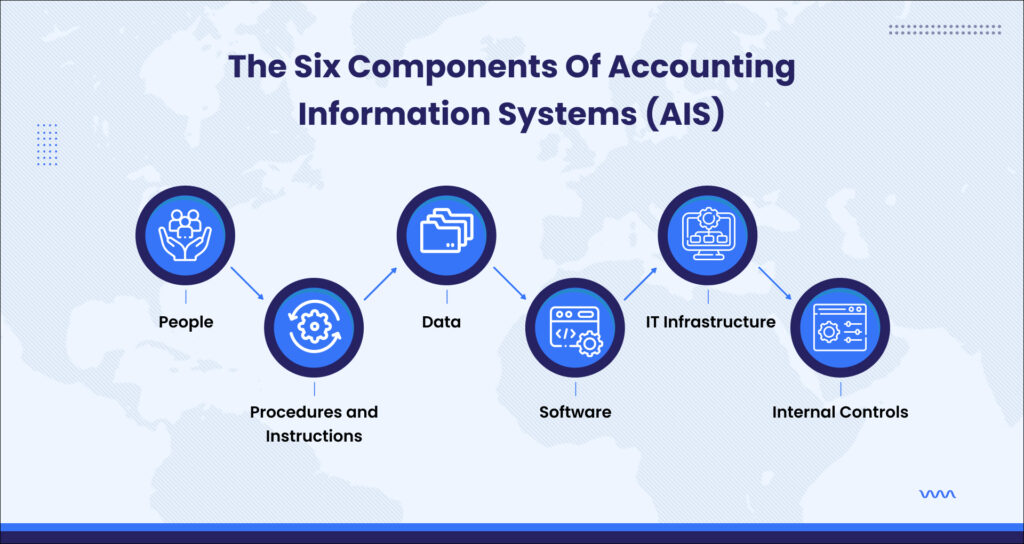

Components of Accounting Information Systems (AIS)

An accounting information approach facilitates accountants, auditors, tax consultants, and chief financial officers to manage their routine financial matters following traditional and technological resources. However, accountants are the frontline users of this system and focus on accurate and transparent bookkeeping records.

Moreover, businesses need to track their accounting activities daily to meet their financial goals. Without discussing the components, it is difficult to analyze the AIS. Here are the six components of the accounting information method!

1- People

People are the top component of AIS, as this system works with multiple departments and authorities that take care of company accounts. These are the certified professionals who also take finance responsibilities into their own hands. People include accountants, consultants, business analysts, chief financial officers, auditors, and managers.

These intellectuals are a part of management that keeps an inventory check and finds the new payable to improve sales. These salespeople check customer orders, and accounting bills and send them invoices using this AIS. After processing the order, they also interact with the shipping department to send the order that the accounting department pays within 90 days.

Following this, the customer service department tracks the order and analyzes the cost process to finally prepare the financial report. Resultantly, this helps consultants to improve the pricing structure and financial condition of the business.

2- Procedures and Instructions

The procedures and instructions are also the basic components of AIS. This is a crucial step that involves the process of collecting, storing, and retrieving the data. Usually, the data comes from an internal source no matter if you follow manual or automatic methods, it always works under AIS software. However, the companies have to follow the AIS procedure and instructions to meet the documentation process.

3- Data

Data is also an essential component of AIS that stores information and works around (SQL) computer language. SQL stands for structured query language that supports AIS to manipulate the data to manage reporting. Further, it also allows users to maintain a data entry system by adding different input screens that drive good outcomes.

No doubt, the data covers financial information that organizations require to undergo useful business practices. It builds momentum and handles the finances through AIS!

Types of Data

Let’s take a look at some essential types of data that go into the AIS for quick processing!

- Sales Order Data

- Customer Billing Statements Data

- Sales Analysis Report Data

- Purchasing Materials Data

- Vendor Invoices Data

- Check Registers Data

- General ledger Data

- Inventory Data

- Payroll Information Data

- Timekeeping Data

- Tax Information Data

4- Software

Software is also an essential feature of AIS that also helps to store, retrieve, collect, and analyze financial data. No doubt, the accounting information system was handled manually before the software and computers were invented. Thankfully, AIS has flourished and replaced with computer software that changed things to a great extent.

Importantly, the software is ideal for small to medium-sized businesses and medium-sized to large businesses. Some of the top-notch software names include Microsoft’s Dynamics GP, Oracle’s PeopleSoft, Epicor Financial Management, and Intuit’s Quickbooks.

5- IT Infrastructure

IT infrastructure is also a crucial component of AIS that includes the entire information technology setup. This includes internet devices, mobile devices, servers, routers, printers, projectors, and most importantly storage media. Despite storage capacity, it also covers speed and device capability that one can expand and upgrade with ease.

6- Internal Controls

Internal control is also a benefit of AIS and is one of the top components that not only protects data but also maintains the entire internal control of an organization. It provides accountants an opportunity to strengthen their internal management including biometric identification, passwords, and security protocols.

Following this, authorized users find access to the system whether they are a part of external or internal management. The system takes action against unauthorized users who try to breach the files. Above all, the system takes care of confidential information that includes social security numbers, personnel information, credit card numbers, customer details, and financial data of customers.

How The Pro Accountants Analyze Financial Statements Using AIS?

If you are searching for a reputed organization to analyze your financial statements using AIS, get in touch with The Pro Accountants to maintain your accounting information system efficiently and accurately. Our certified accountants are always there to help you with excellent services, as they focus and monitor the AIS database with detailed analysis to prevent fraud. For more details, let’s speak to our experts!