Every business owner desires to improve revenue and this particular thought applies to all entities regardless of their size and business nature. However, a strong and reliable accounting system plays an excellent role in fulfilling this dream. With proper accounting and finance management, a business gets an opportunity to track financial data along with profit and loss statements during the fiscal year.

Profitability remains the top concern of companies and the need to go through financial statements to drive net income. On the contrary, this strategy doesn’t seem to be right for government institutes and nonprofit organizations. These organizations never focus on profitability, as their ultimate target is to collect funds for charitable purposes. This is why, their entire system revolves around fund management.

What is Fund Accounting?

Fund accounting is a special type of accounting service that deals with funds for different purposes. The major purpose of this accounting is to track funds within nonprofit organizations to smoothly regulate the finance system. It is understood that nonprofit firms allocate funds for efficient running of projects and that’s the reason this system is entirely different from normal businesses.

Additionally, the element of profit is missing from this system and that’s an interesting part of fund management. The accountants pay more attention to accountability rather than profitability due to the involvement of funds. This is why, they prepare final reports to figure out the utilization of money. With this, it becomes easier for experts to check whether funds have been spent for the right purposes. In case of any problem, nonprofits have the authority to report this issue to third parties.

The expertise of accountants helps them track the cash to be spent on nonprofit activities. Interestingly, this allows top management to make appropriate decisions that result in the growth of the company.

How do financial planners track these funds? Of course, they prepare a balance sheet after gathering financial data to track the activities regarding funds. As far as fund types are concerned, it varies in nature.

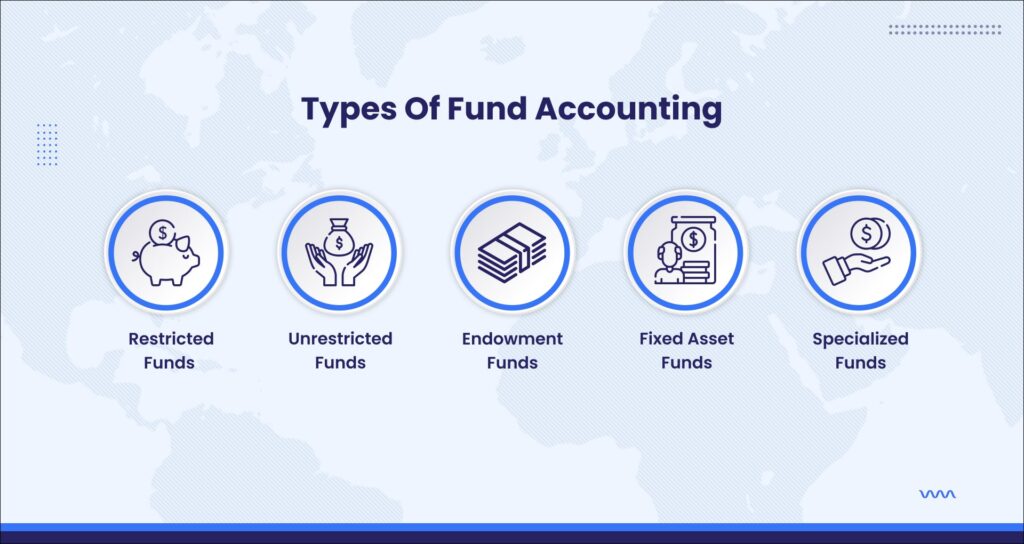

Types of Fund Accounting

Fund management always comes with a nonprofit concept that has multiple uses and types. Let’s take a look at the types!

Restricted Funds

Restricted funds come with restrictions from donors and nonprofits have to utilize these funds for specific projects only. Furthermore, the experts keep transparency while keeping the records.

Unrestricted Funds

Unrestricted funds are opposite restricted funds, as these funds come with no dictation and management is free to use them as per their feasibility. Nonprofit organizations don’t have to seek permission from the donor regarding the use of funds.

Endowment Funds

Endowment funds have specific purposes. Usually, these types of funds are specifically allotted for charitable purposes and given to hospitals, schools, universities, and churches.

Fixed Asset Funds

Fixed asset funds are ideal for maintaining financial resources such as machinery, transport, buildings, land, and equipment. Interestingly, these funds can be used to repair the cost of fixed assets.

Specialized Funds

Specialized funds are flexible and can be used for multiple purposes. Therefore, nonprofit organizations use them to maintain all types of assets.

Furthermore, fund accounting can provide nonprofits with some advantages and disadvantages. Some of the benefits of this system include the following.

Advantages and Disadvantages of Fund Accounting

Here are some advantages and disadvantages of funds management that circulate in the accounting system!

Advantages

- Promotes accountability and never focuses on profitability

- Helps nonprofits to know the difference between restricted and unrestricted funds

- Allows nonprofits to make the best use of unrestricted funds

- Allows nonprofits to spend cash and similar resources that are of the same value

Disadvantages

- Stops nonprofit management to use restricted funds as per their desire

- Increases the workload of nonprofit organizations by allocating different types of funds

- Unclears nonprofit firms regarding the utilization of money by offering specialized funds

- Never clears the financial position of nonprofit agencies

Fund Budgeting

Along with the advantages and disadvantages of fund bookkeeping, organizations have to keep a record of fund budgeting to maintain discipline and promote transparency at work. It helps accountants track the total expenses and know the types of funds being allotted by donors during the budgeted year. Of course, nonprofits have to spend the available funds for a good cause and that’s why budgeting is a critical element that one can’t ignore from the process.

Examples of Organizations That Use Funds

Here are the entities that use funds for several reasons!

Governmental Funds

The governmental funds are those funds that come under the authorization of the government. Therefore, the money spent on government projects whenever this fund comes into action. Let’s overview some examples of this category!

Capital Project Funds

This fund refers to the financial resources and the amount is spent on major projects.

Debt Service Funds

Debt service funds refer to the financial resources that are specifically used for paying interest.

General Funds

This fund refers to the financial resources that are not included in other funds.

Permanent Funds

Permanent funds are typically utilized for supporting government programs.

Special Revenue Funds

These are special funds that target revenue sources and nonprofits use them to manage expenditures.

Proprietary Funds

Proprietary funds are allotted for commercial activities organized by the government. The category includes:

Enterprise Funds

Enterprise funds are allotted for business activities that take place in the firm, whereas outside users have to pay a fee for using goods and services.

Internal Service Funds

Internal service funds support other funds to be utilized in the organization.

Fiduciary Funds

Fiduciary funds are held by the firms and these are used for providing support to the organizations and even the governments, The category includes:

Agency Funds

These funds are used according to the custodial capacity and used for doing temporary business investments.

Investment Trust Funds

Investment trust funds are used for government-sponsored programs.

Pension and Employee Benefit Funds

These funds fall in the category of pension plans and employee benefits.

Private Trust Funds

These are used for managing trust arrangements for individuals, private and governments.

Did You Know?

“To keep track of your fund accounting duties, you need to entrust them to fund accounting experts. Remember, it isn’t everyone’s business to manage funds.”

Manage Fund Accounting with The Pro Accountants

Are you searching for a reputed accounting firm to efficiently manage your funds? The Pro Accountants has got your back with exceptional fund accounting services as per your suitability. Our accountants can assist you with a wide range of funds to efficiently run your nonprofit firms. Let’s contact our experts!

Wrap Up

Finally, we’ve gone through a wide range of funds that nonprofit organizations handle to manage the finance system. The accountants who deal with funds are allowed to make final reports based on the financial data of funds concerning their utilization and type.