Accounting and finance provide a systematic framework for recording financial transactions in every company. Likewise, marketing and sales, accounting also serve as the backbone of every firm and help top management to make good decisions. With the absence of an accounting management department, it would be very challenging for organizations to figure out the revenues, expenses, assets, and liabilities. This is why, accounting management services play a vital role in the success of a business through strategic planning.

Table of Contents

What is Managerial Accounting?

Managerial accounting isn’t a typical accounting service when compared to financial accounting. It covers the wider aspect of management and focuses on analyzing, interpreting, and passing on financial information to higher management through prompt communication. Additionally, this branch of accounting plays a managerial role in a company for better internal decision-making.

No doubt, the success of a business depends on smart decisions, whereas management accounting can make a big difference. Importantly, The Pro Accountants play an efficient role in the accounting management process, as they always empower top managers by keeping an eye on internal operations that include planning, spending budgets, and cost control operations to improve strategic decisions.

Key Features

- Represents financial information to executives after proper analysis and interpretation

- Serves the internal purpose of an organization for better decision-making

- Involves managerial techniques rather than following typical accounting standards

- Covers financial analysis based on product costing, budgeting and cost accounting

- Differs from financial accounting practices and relies on prompt communication

How Managerial Accounting Works

Management accounting is entirely a different model from finance accounting and links more with cost systems. The purpose of this accounting is to improve the decision-making skills for smoothly managing the internal affairs of a company. However, the decisions depend a lot on the analysis and interpretation of financial information that revolve around the cost and sales revenue of goods and services that a company manufactures and sells.

Additionally, cost accounting works under management accounting, and both have deep connections. For this, managerial accountants analyze the entire cost system and determine the difference between variable and fixed costs to drive the total cost of production. With this amazing process, accountants can control the unnecessary spending that ultimately results in higher profits.

The Difference Between Managerial and Financial Accounting

Management accounting is an internal process that interacts with executives and managers who are responsible for making crucial decisions that improve the sales and profits of the company. Therefore, financial accounting is an external process that works to improve the financial statements of a company. An accountant doesn’t have to follow the accounting principles and guidelines in managerial costing, whereas every accountant has to follow generally accepted accounting principles (GAAP) to meet the requirements.

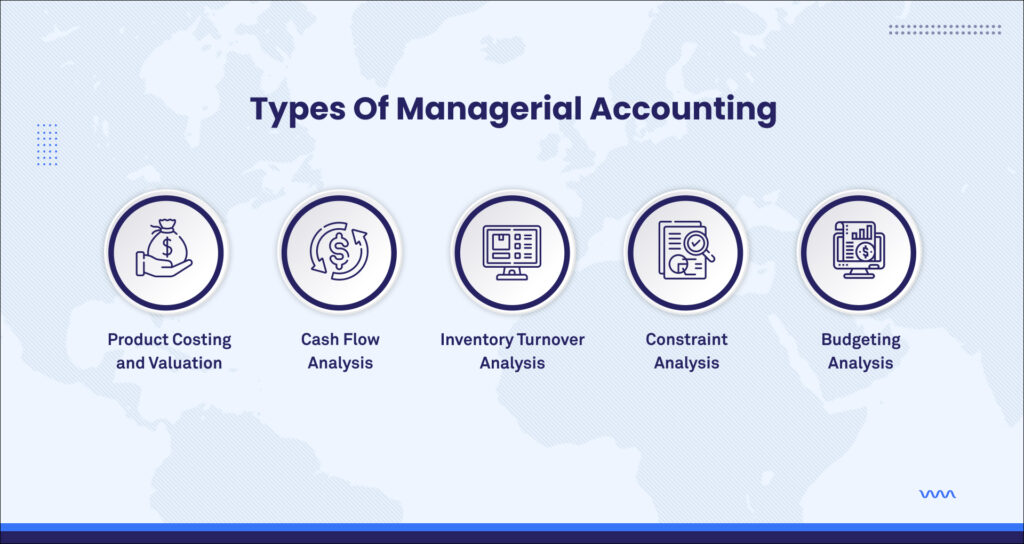

Types of Managerial Accounting

Let’s overview the types of management accounting!

Product Costing and Valuation

Product costing is an important type of managerial costing that evaluates the total cost included in the production of goods and services. In this particular type, accountants make the subcategories of cost that cover direct, indirect, variable, and fixed costs. The actual thing is to identify all the costs involved in the process that also cover overhead costs.

For this task, managerial accountants having excellent command over cost accounting provide tremendous services, as they calculate overhead charges and figure out the expenses along with the production cost. However, the job is tricky and requires thorough analysis at different stages.

It also relates to marginal accounting, where experts calculate the cost of additional units while keeping in mind the economic conditions. It’s an evaluation process that has a positive impact on the overall profit of the organization. Above all, accountants also go through break-even analysis to figure out the status of a business.

Cash Flow Analysis

Cash flow analysis is a must in managerial accounting services. A managerial accountant evaluates the impact of cash by doing a proper cash flow analysis. Many firms record their financial information on an accrual basis to know the impact of financial transactions. This clears the financial position of the company and experts get an opportunity to implement a capital management strategy by giving importance to the cash flow system.

Management accounting strategy keeps a complete check on cash inflow and outflow before making investment decisions. Therefore, an accountant has to play an effective role while setting up purchases for the business. If cost accounting delivers exceptional results, then it helps a company to find success.

Inventory Turnover Analysis

Inventory turnover analysis is also crucial in today’s business world, especially when it comes to finding out the number of inventory calculations taken into consideration by the company. Inventory calculation gives an estimation to manufacturers and marketers before they plan new purchases. Indeed, it improves the decision-making of organizers allowing them to cut down expenses and boost profitability. With improved decisions, an accountant can free up cash flow and reduce storage costs that ultimately benefit the company.

Constraint Analysis

Constraint analysis is a must that experts have to consider important in management accounting. In this analysis, an accountant reviews the constraints and evaluates the weak points and drawbacks that become hurdles in growth. Therefore, an accountant comes up with a logical analysis after calculating the revenue, profit, and cash flow system. However, this analysis always brings an improvement in sales and allows managers to make perfect decisions.

Budgeting, Trend Analysis, and Forecasting

Management accounting analysis is not complete unless you include budget, trends, and forecasting. Budget is the decisive factor that sets the tone for organizing the smooth operations of a company. Hence, accountants overview performance reports to determine the actual budget results. This allows them to make proper and timely decisions concerning variance.

Furthermore, budgeting, forecasting, and trend analysis assist decision-makers in finding growth. Of course, accountants prepare proposals and find interesting ways to make purchases that boost their financial options and anticipate future decisions.

Expenses and variances are also involved in this process which also brings a rapid improvement in financial management. But the entire credit goes to the managerial accountants who assess the cost system and deliver relevant information to CFOs for creating a fabulous output.

Management Accounting and GAAP

Whenever we talk about management cost accounting, we come across different accounting criteria that follow internal company metrics well focused on the performance of the organization. Generally accepted accounting principles have nothing to do with managerial costing, as this principle applies to finance accounting by covering external metrics.

Seek Managerial Accounting Services With The Pro Accountants

Are you looking for a trusted managerial accountant to resolve the growth matters of your business linked with accounts and finance? Let’s get in touch with The Pro Accountants to find long-term reliable solutions that come with proper analysis for all-sized businesses. Our certified accountants analyze the cost accounting system and compute information that allows chief financial officers and top management to make informed decisions leading to success. Let’s grab the opportunity and contact our qualified professionals!

Final Thoughts

In the above discussion, we’ve understood managerial accounting with its core elements and types. The entire discussion is around cost accounting management which plays a huge part in setting up the internal affairs of a company. The managerial system is quite different from finance accounting, as it follows the analysis of financial statements and cost elements by supplying accurate information to managers for smooth decision-making.