Picture a scenario where you’re a small business owner, and the stress of managing your finances is overwhelming. Piles of receipts are scattered across your desk, invoices are buried in your email, and the thought of tax season keeps you up at night.

If this sounds familiar, you’re not alone. Many business owners face these same challenges. The good news is that there’s a powerful tool at your fingertips that can help you streamline your financial management—Excel. In this blog, we’ll dive into how you can use Excel for accounting and bookkeeping to bring order to the chaos, making your life easier and your business more efficient.

Why Excel?

Excel is more than just a spreadsheet tool; it’s a versatile and powerful application that can handle various accounting and bookkeeping tasks. With its wide range of functions and formulas, it can help you track expenses, manage invoices, create financial statements, and analyze data. Here’s how you can make the most of it for your business’s financial management.

Setting Up Your Excel Workbook

The first step is setting up your workbook. A well-organized workbook will be your foundation for effective financial management. Here’s how to get started:

- Create a Master Workbook: This will be the central file where all your financial data is stored. Name it something like “Business Finances 2024.”

- Set Up Separate Sheets: Within your master workbook, create separate sheets for different aspects of your finances. Common sheets include:

- Income: Record all revenue streams.

- Expenses: Track all business-related costs.

- Invoices: Manage issued and received invoices.

- Payroll: Monitor employee payments and related expenses.

- Financial Statements: Generate reports like balance sheets and income statements.

- Customize Each Sheet: Tailor each sheet to suit your business’s needs. For example, in the “Expenses” sheet, create columns for the date, description, category, and amount.

Tracking Income and Expenses

Tracking income and expenses is a fundamental part of bookkeeping. Excel can simplify this process significantly.

- Income Sheet:

- Date: When the income was received.

- Source: The client or revenue stream.

- Amount: The total received.

- Category: Type of income (e.g., sales, service fees).

- Expenses Sheet:

- Date: When the expense was incurred.

- Description: What the expense was for.

- Category: Type of expense (e.g., office supplies, utilities).

- Amount: The total cost.

By regularly updating these sheets, you’ll have a clear picture of your financial position. You can use Excel formulas like SUM to total your income and expenses, making it easy to see where your money is coming from and where it’s going.

Managing Invoices

- Issued Invoices:

- Invoice Number: A unique identifier for each invoice.

- Date: When the invoice was issued.

- Client: The recipient of the invoice.

- Amount: The total amount due.

- Due Date: When the payment is expected.

- Status: Whether the invoice is paid, pending, or overdue.

- Received Invoices:

- Invoice Number: Provided by the vendor.

- Date: When the invoice was received.

- Vendor: Who issued the invoice?

- Amount: The total amount due.

- Due Date: When the payment is due.

- Status: Whether the invoice is paid, pending, or overdue.

Payroll Management

Payroll management is another critical area where Excel can be a valuable tool. Here’s how you can set up a payroll sheet:

- Employee Information:

- Employee Name: Full name of the employee.

- Position: Job title.

- Pay Rate: Hourly or salaried rate.

- Hours Worked: Total hours worked in the pay period.

- Gross Pay: Total pay before deductions.

- Deductions:

- Taxes: Federal, state, and local taxes.

- Benefits: Health insurance, retirement contributions.

- Other Deductions: Any other payroll deductions.

- Net Pay: Gross pay minus total deductions.

Using formulas, you can automate calculations for gross pay, total deductions, and net pay, ensuring accuracy and saving time.

Creating Financial Statements

Financial statements provide insights into your business’s financial health. Excel can help you create essential financial reports, such as:

- Balance Sheet:

- Assets: List all assets, including cash, inventory, and property.

- Liabilities: List all liabilities, including loans and accounts payable.

- Equity: Owner’s equity or retained earnings.

- Income Statement:

- Revenue: Total income.

- Expenses: Total expenses.

- Net Income: Revenue minus expenses.

- Cash Flow Statement:

- Operating Activities: Cash generated from operations.

- Investing Activities: Cash used for investments.

- Financing Activities: Cash from financing activities.

By using Excel formulas and functions, you can automate the creation of these statements, making it easier to analyze your financial performance.

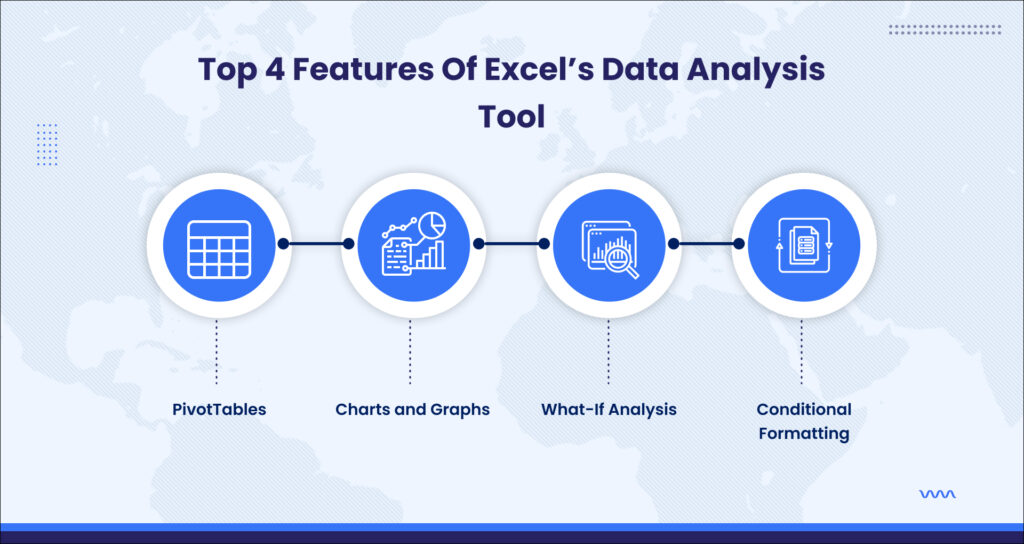

Analyzing Financial Data

Excel’s data analysis tools can provide valuable insights into your financial data. Here are some useful features:

1. PivotTables: Summarize large amounts of data and find patterns.

2. Charts and Graphs: Visualize your financial data to identify trends.

3. What-If Analysis: Explore different financial scenarios and their potential outcomes.

4. Conditional Formatting: Highlight key data points, such as overdue invoices or high expenses.

These tools can help you make informed decisions based on accurate and comprehensive financial data.

Ensuring Accuracy and Compliance

Maintaining accurate records and ensuring compliance with financial regulations is critical. Excel can help you achieve this with:

1. Data Validation: Set rules to ensure data is entered correctly.

2. Audit Trail: Keep track of changes made to your financial records.

3. Backup and Security: Regularly backup your Excel files and use password protection to secure sensitive information.

These practices help you maintain accurate records and protect your business from potential issues.

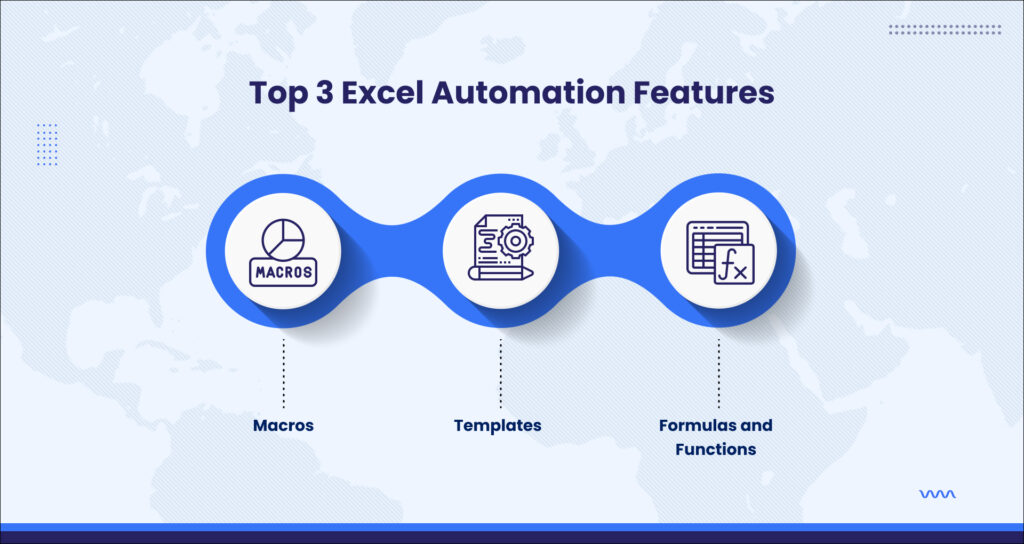

Automating Repetitive Tasks

Excel’s automation features can save you significant time and effort. Here’s how to make the most of them:

- Macros: Record and automate repetitive tasks, such as data entry and report generation.

- Templates: Use pre-built templates for common accounting and bookkeeping tasks.

- Formulas and Functions: Leverage Excel’s wide range of formulas and functions to automate calculations and data analysis.

By automating repetitive tasks, you can focus on more strategic aspects of your business.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Advanced Tips and Tricks

To further enhance your Excel skills, consider these advanced tips and tricks:

- Using Power Query: Import, transform, and analyze data from multiple sources.

- Creating Dashboards: Build interactive dashboards to visualize key financial metrics.

- Leveraging VBA: Use Visual Basic for Applications (VBA) to create custom functions and automate complex tasks.

These advanced techniques can help you unlock Excel’s full potential for accounting and bookkeeping.

Training and Continuous Learning

Excel is a powerful tool, but it requires continuous learning to stay updated with new features and best practices. Here’s how to stay ahead:

- Online Courses: Enroll in online courses and tutorials to enhance your Excel skills.

- Webinars and Workshops: Attend webinars and workshops on Excel for accounting and bookkeeping.

- Practice and Experimentation: Regularly practice and experiment with new Excel features and techniques.

Continuous learning will help you stay proficient and make the most of Excel for your business’s financial management.

Excel can be an invaluable tool for managing your business’s accounting and bookkeeping needs, but setting everything up can be daunting. If you’re feeling overwhelmed, The Pro Accountants are here to help. They specialize in tailoring Excel to fit your unique business requirements.

Why Choose The Pro Accountants?

The Pro Accountants will customize your Excel workbook, creating templates and automated systems that simplify your financial management tasks. We offer continuous support, ensuring your financial data is always accurate and up-to-date.

Beyond just managing numbers, The Pro Accountants provide strategic insights to help your business grow. We analyze your financial data to identify trends, forecast future performance, and offer advice on how to optimize your financial strategy.

In short, by partnering with us, you can focus on running your business without the stress of managing finances. We ensure compliance with tax regulations, prepare for audits, and manage all financial aspects, giving you peace of mind.

Moreover, we work closely with you to understand your specific needs and tailor their services accordingly. Whether you’re a small business owner, freelancer, or non-profit, we have the expertise and dedication to help you succeed.

So, let us handle the complexities of financial management while you focus on what you do best – growing your business.