You’re juggling countless tasks as a business owner, and managing your finances is one of the most stressful things. The lines between bookkeeping and accounting can blur, making it challenging to understand their distinct roles, and this can even lead to missed opportunities, compliance issues, and financial mismanagement. Before excelling in this field, you need to first understand the difference between bookkeeping and accounting. In this blog, we’ll break down these roles, helping you see how each can address your challenges and drive your business forward.

The Basics of Bookkeeping

Bookkeeping is the foundation of your business’s financial health. It’s all about keeping meticulous records of every transaction that occurs. Here are the core aspects of bookkeeping that you need to understand:

- Recording Transactions: This involves noting every sale, purchase, payment, and receipt. Accurate transaction recording ensures your financial records reflect reality.

- Managing Accounts: Bookkeepers handle your accounts payable and receivable. They track what you owe to suppliers and what customers owe you, helping maintain a healthy cash flow.

- Reconciling Accounts: Regular reconciliation of your bank statements with your financial records is crucial. This process identifies discrepancies, ensuring your records are accurate.

By keeping precise financial records, bookkeepers provide the foundational data needed for advanced financial analysis and decision-making.

The Fundamentals of Accounting

Accounting builds on the data provided by bookkeeping to offer insights that guide your business strategy. As of 2024, there are approximately 90,475 businesses in the accounting services industry in the United States. This industry encompasses a range of activities, including auditing, bookkeeping, payroll processing, and tax preparation services. Moreover, it involves analyzing, interpreting, and reporting financial information. Here’s what you should know about accounting:

- Financial Statements: Accountants prepare vital documents like balance sheets, income statements, and cash flow statements. These give you a comprehensive view of your business’s financial health.

- Tax Compliance: Accountants ensure you meet all tax obligations. They prepare and file tax returns, helping you avoid penalties and optimize your tax situation.

- Financial Analysis: Accountants delve into your financial data to identify trends, assess performance, and provide strategic advice. This includes budgeting, forecasting, and uncovering areas for cost savings.

While bookkeeping is about transaction recording, accounting is about strategic interpretation. Accountants use the data from bookkeeping to help you make informed decisions and plan for the future.

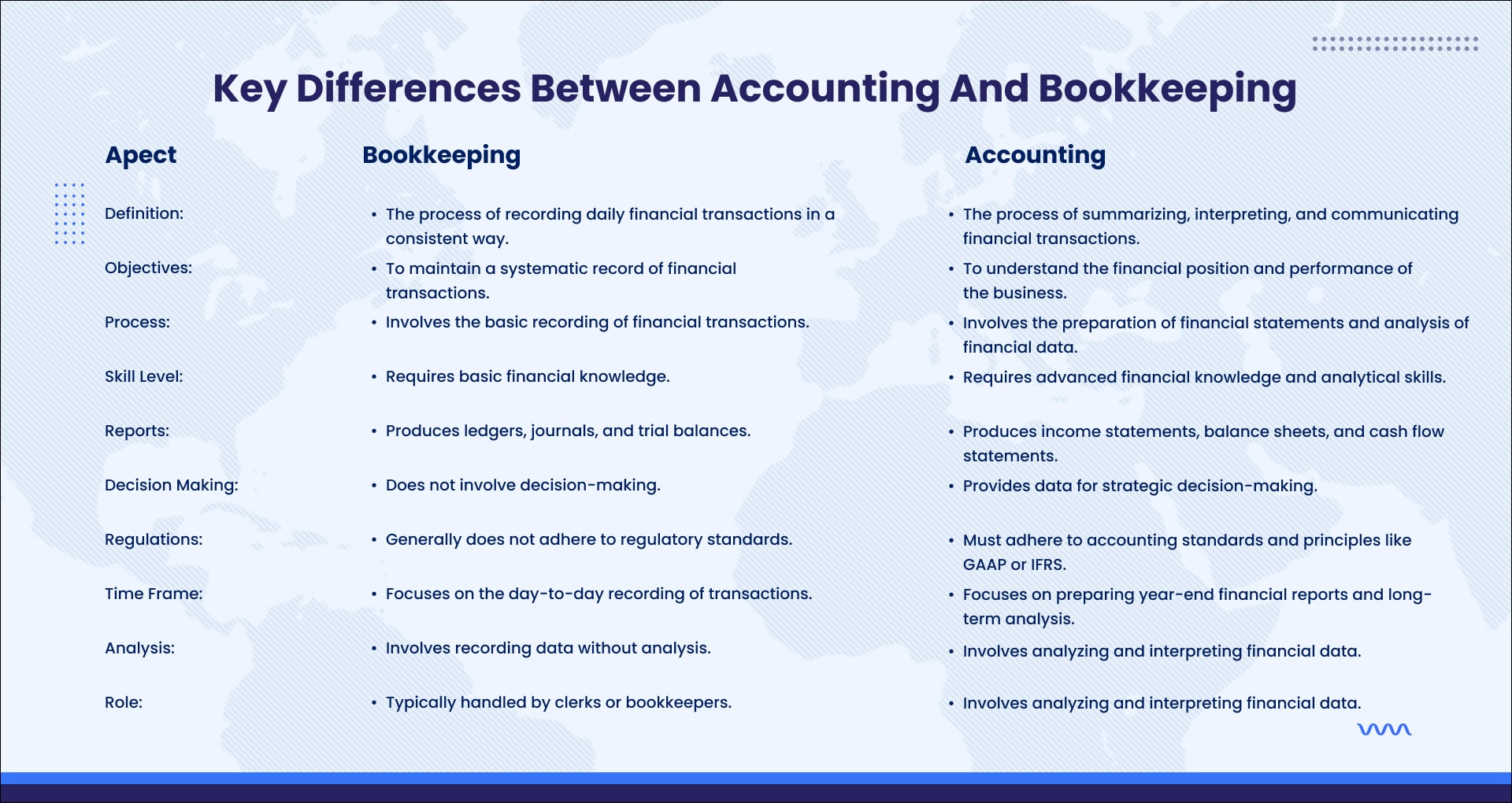

Key Differences between accounting and bookkeeping

Understanding the differences between bookkeeping and accounting is vital for effective financial management. Here are the primary distinctions:

Importance of Bookkeeping and Accounting in Business

The importance extends beyond internal management. Accurate financial records and transparent reporting are vital for securing financing from banks or attracting investors.

They provide a clear picture of a business’s financial health and potential, instilling confidence in external parties. Moreover, during audits or tax filings, well-maintained records and thorough accounting practices can streamline the process, minimizing errors and avoiding potential legal issues.

Why Understanding the Difference Matters?

Recognizing the difference between bookkeeping and accounting helps you:

- Hire the Right Professionals: You can hire the right expertise for each task, ensuring your financial management is in capable hands.

- Ensure Accurate Records: Accurate bookkeeping provides reliable data for accounting analysis.

- Make Informed Decisions: Strategic insights from accounting enable you to make informed business decisions based on thorough financial analysis.

By distinguishing between these functions, you can better allocate resources and streamline your financial operations.

Common Misconceptions

Bookkeeping and accounting are often misunderstood fields, leading to several common misconceptions. One prevalent myth is that bookkeeping and accounting are the same. In reality, bookkeeping ensures accurate data collection, accounting leverages that data for strategic decision-making and financial planning.

Another common misconception is that they are only necessary for large businesses. Small business owners might believe that they can manage without these practices or that they are only relevant for tax purposes. However, regardless of the size of the business, maintaining accurate financial records is essential for tracking income, expenses, and profitability.

Many people also mistakenly think that these are purely historical activities with little impact on future planning. While they do involve tracking past transactions, their primary value lies in informing future business decisions. Accurate financial records provide a detailed picture of a business’s financial performance, allowing for more precise budgeting, forecasting, and strategic planning.

Thus, rather than being merely backward-looking, these practices are integral to forward-thinking business management and growth.

Benefits of Professional Services

Hiring professional bookkeeping and accounting services offers significant benefits:

Accuracy: Professional bookkeepers ensure precise financial records, reducing errors that could lead to financial discrepancies or legal issues.

Expertise: With access to skilled professionals, businesses benefit from up-to-date industry practices and financial strategies for optimal management.

Time-saving: Outsourcing bookkeeping frees up time for business owners to focus on core activities like growth and customer service.

Compliance: Experts ensure adherence to tax laws and regulations, minimizing risks of non-compliance and legal issues.

Scalability: Professional services offer scalable solutions, adjusting as the business grows without constant restructuring.

Advanced Technology: Utilizes the latest software for accuracy, efficiency, and secure data storage, providing real-time financial data.

Cost-effective: Reduces costs of hiring and training in-house staff, as businesses only pay for needed services.

Strategic Planning: Provides insights and advice for business growth, helping to set financial goals and develop achievement plans.

Risk Management: Identifies and mitigates financial risks with robust controls and regular audits, protecting against financial threats.

Financial Reporting: Generates detailed reports for better decision-making, offering insights into financial health and performance.

The Pro Accountants: Your Financial Partner

If you’re looking for a trusted partner to handle both your bookkeeping and accounting needs, consider The Pro Accountants. With a team of experienced professionals, we offer a full range of services to ensure your financial records are accurate, compliant, and insightful. Let us help you navigate the complexities of financial management so you can focus on growing your business with confidence.